USD/JPY Analysis, Sentiment and Chart

Japanese Yen Prices, Charts, and Analysis

- Tokyo CPI rises to 2.2% in May.

- USD/JPY traders wait for US inflation data.

Recommended by Nick Cawley

Get Your Free JPY Forecast

Tokyo Inflation Report Signals Rising Price Pressures in May

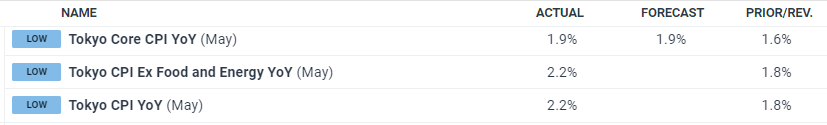

The latest Tokyo inflation report, widely regarded as a leading indicator for national inflation trends, reveals increasing price pressures in May. The core Consumer Price Index (CPI), which excludes fresh food, rises in line with forecasts to 1.9% year-on-year, up from 1.6% in April. Meanwhile, the headline CPI, which includes all items, climbs from 1.8%, a two-year-plus low, to 2.2% year-on-year.

This upward movement in inflation is a positive development for the Bank of Japan. However, it will unlikely prompt the central bank to tighten its monetary policy in the coming weeks. The Bank of Japan closely monitors price dynamics to achieve its longstanding 2% inflation target sustainably and stably.

As the Tokyo region serves as a bellwether for broader inflationary trends in Japan, the latest figures underscore the continued recovery in consumer prices. Policymakers and market participants will scrutinize upcoming national inflation data (June 20th) for further signs of sustained price growth, which could influence the Bank of Japan’s future policy decisions.

For all market-moving global economic data releases and events, see the DailyFX Economic Calendar

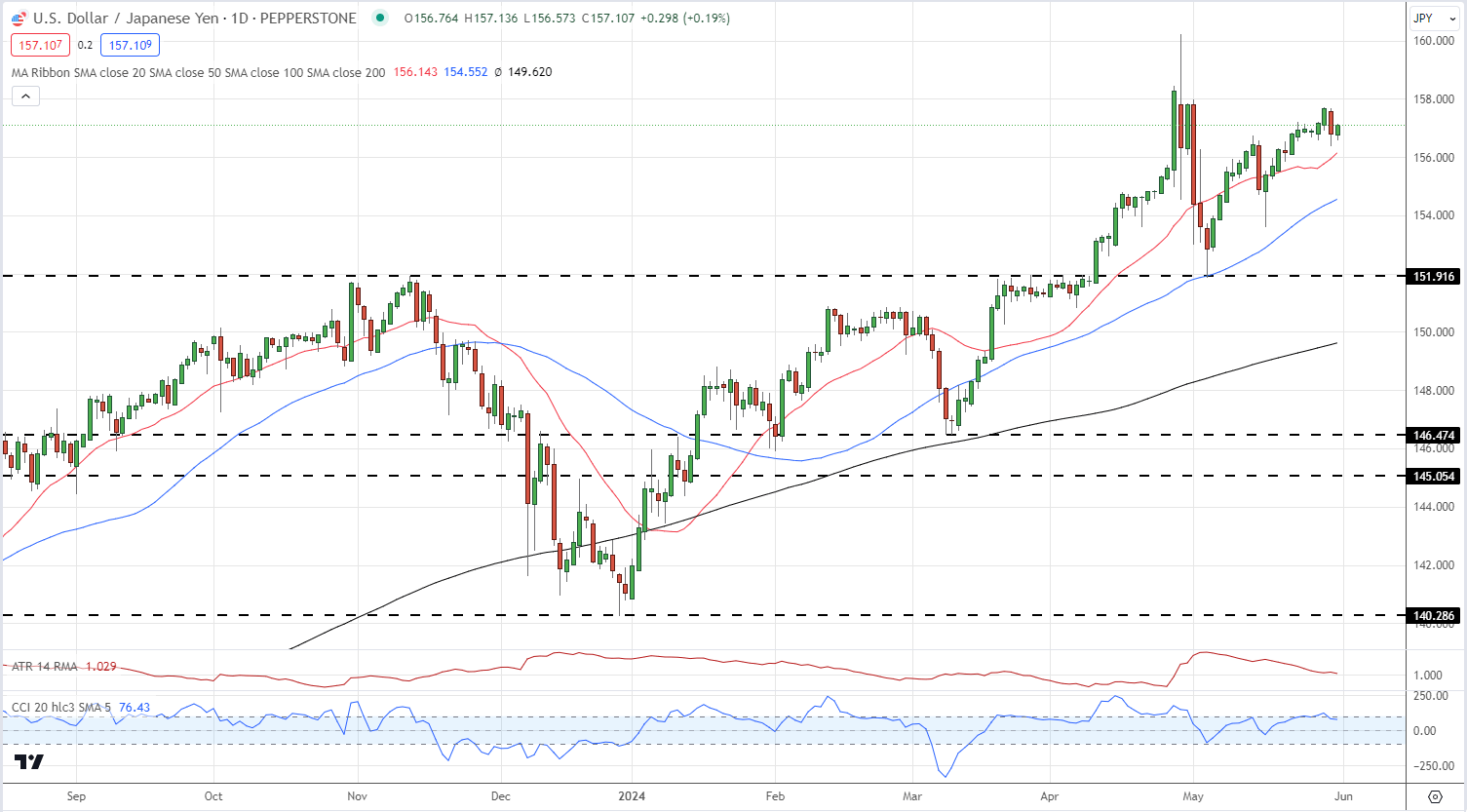

The Japanese Yen barely moved after the data was released with USD/JPY traders waiting for today’s US Core PCE data (13:30 UK) before taking any positions ahead of the weekend. USD/JPY is trading on either side of 157.00, which has previously prompted official warnings over excessive Yen weakness. Japanese officials will closely watch today’s US inflation data and the US dollar’s response.

USD/JPY Daily Price Chart

Retail trader data show 25.18% of traders are net-long with the ratio of traders short to long at 2.97 to 1.The number of traders net-long is 3.42% lower than yesterday and 11.68% lower than last week, while the number of traders net-short is 4.31% lower than yesterday and 1.38% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The current sentiment and recent changes combine us with a further mixed USD/JPY trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 11% | -2% | 1% |

| Weekly | -7% | -3% | -4% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.