It is an accepted part of self-help wisdom that it takes twenty-one days to develop a new habit and make it stick. This has been found to be true in weight loss, smoking cessation, reducing alcohol consumption, and many other regimens designed to create positive money habits. It can also be applied to your finances. If you are having trouble getting motivated to create a better financial life, a dedicated effort over just twenty-one days can create better money management habits.

Of course, it’s not a miracle cure. If you’re in deep financial trouble you certainly won’t be able to solve all your problems or pay all your debt in twenty-one days. That’s not the point. What you’re trying to do over these twenty-one days is to lay the foundation for tackling your money problems over the longer haul. You use these twenty-one days to create better financial habits so you can get out of trouble and avoid getting in trouble next time. If you’re doing nothing about your finances, these twenty-one days can get you started on the basics.

Below are twenty-one things you can do to create better money management habits. Each one is small enough to be done in a day. (Depending on your situation it may require a long day, but it can be done in a day.) Do one thing per day (you don’t have to do them in order) and you should be on your way to better money management habits. If you can go for three weeks without falling back into your old patterns, you stand a better chance of coming out on the other side with new, ingrained, money management habits.

1. Figure out exactly how much you owe.

This sounds like a “duh,” but you can’t make a plan without knowing exactly how much you owe and to whom. It’s time to come clean. List all loans, lines of credit, HELOC’s, credit cards, “X months same as cash” offers, 0% financing, etc. List everything, no matter how small, including that $10 you owe your coworker for lunch last week. If you don’t know what you owe, you can’t create a plan to become wealthier.

Doing this is pretty simple, you just need a piece of paper, or a computerized spreadsheet. Then you list everything you owe, the amount of the monthly payments — and how expensive the debt is (or the interest rate you’re paying on it). Then think about how you you want to pay it off.

2. Figure out exactly how much you have.

Tally up all your assets, including cash, 401(k)’s, IRA’s, stocks/bonds, your change jar, and the money in your mattress. If possible, include an approximate value for your house, if you own one. Don’t count “expected” money like tax refunds or inheritances until you have them. Expected money is not money you have. Many people have no idea how much they have (or don’t have). It is hard to create any sort of financial plan without knowing exactly how much you have.

3. Figure out your net worth.

Figuring your net worth is very simple. You just subtract how you owe from how much you have (your assets minus liabilities). This is your net worth. It’s a handy number to know. If it’s positive, you’re doing some things right and you want to keep heading in that direction. If it’s negative, you’ve got problems and need to work on them ASAP. It’s not a number that matters to anyone but you, but it is a good indicator of where you’ve been and where you’re heading. Its important to do this regularly. This is because what gets measured, gets improved.

4. Know how much you bring home every month.

As surprising as this sounds, many people don’t know how much income they have. Many people often bring but not how much they actually bring home each month. Figure out what you actually bring home after taxes, insurance, flex spending, 401(k) and any other deductions. You can also include interest you earn on savings, as long as withdrawing that interest won’t cost you penalties. This is the amount you have to work with every month to spend, save, and pay down debt.

5. Get your credit reports from all three credit bureaus.

You can get one free per year from each bureau at AnnualCreditReport.com. Check for inaccuracies, debts you’ve forgotten about (if you find any, adjust your numbers in #’s 1, 2 and 3), and anything else that doesn’t seem right. Figure out a plan of attack for resolving any errors and cleaning up your report. A clean report makes it easier to qualify for car loans and mortgages, if you need them.

You can find the website for annual credit report here.

Whatever you do, don’t pay to get your credit report. You can get it for free at annualcreditreport.com. Your bank or credit union may also be able to give it to you for free.

6. Identify your spending drains.

Spending money is a fact of life. Everyone has spending drains. Some people like to eat out, some people collect things, some people can’t part with their morning coffee. A lot of times these spending drains are almost unconscious.

One good way to get a handle on your spending is to use a budget/expense tracking app. These track all your electronic transactions, and categorize them. Good apps are Lunch Money (which is new, and well designed) and Quickens Simplifi product. Quicken’s product is more developed, but Lunch Money is newer and better tuned into its users needs.

You can find Lunch Money here, Quicken is here.

7. Don’t spend anything for one day.

Go just one day and spend nothing. Don’t buy coffee, don’t go to the drive-thru, don’t stop at Target for “just one thing.” Don’t even buy gas. See how good it feels to go without spending for a day. Now try to add more no-spend days to your life.

8. Figure out your fees.

Pull out your bank and credit card statements and looks at the fees you’re being charged for overdrafts, ATM withdrawals, late fees, account maintenance fees, etc. Figure out a way to eliminate these fees-call the bank and negotiate, stop doing whatever it is that’s incurring the fees, or switch banks if they won’t work with you.

9. Organize your bill paying.

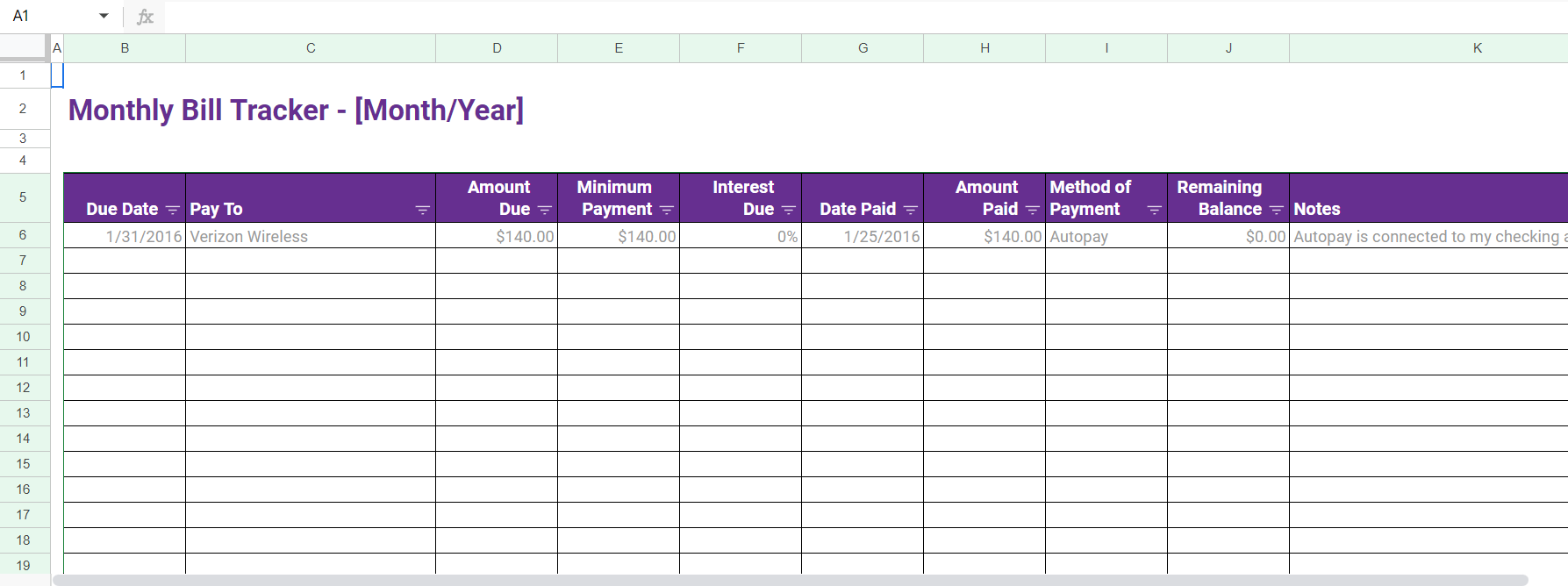

Organization is not a bag or shoe box stuffed with unpaid bills. Create a system so that when a bill comes in, it goes into a holding area until it’s paid. Put your bill paying supplies in one place to minimize the aggravation. Then create a system to keep records of your payments. Get a filing cabinet or file box to keep the receipts. If possible, automate as many bill payments as you can so you don’t have to worry about it. Maybe you need to make a spreadsheet listing all bills and their due dates so you can check them off as you go. Clear the sheet at the end of the month and begin again next month.

Here is a great example of what a bill tracker looks like:

You can find this tracker here.

10. Start keeping your receipts for purchases.

Many people buy something and simply toss the receipt. Store them in an envelope, labeled by month. Keep receipts at least until the return period has passed for the item. More and more stores are requiring receipts for returns. Not having the receipt could cost you. You also want to keep receipts until the purchases have cleared your bank account. Keeping receipts also helps you in case you need to track your expenses.

11. Get a shredder and use it.

Shred anything with personal or financial information on it to reduce your risk of identity theft. Shredders have really come down in price and they are worth the peace of mind. Right now Amazon is selling a great one for under $40 bucks, which is really inexpensive.

This is a good example:

12. Balance your checkbook.

Even if you use online banking or a money management program, reconcile your bank statement with your checkbook every month. Banks make mistakes or you might enter something incorrectly. Make sure you know that your accounts are correct every month. You may also catch expenses or income you didn’t know you had.

13. Examine your insurance policies.

Know what your homeowners’, health, life, and car insurance policies cover and how much you’re paying for that coverage. If you think you’re underinsured, schedule a talk with your broker ASAP to set things right. You should also make note of when the policy premiums are due.

14. Check to make sure you’re not paying more than you have to for insurance.

Once you know what you have and how much insurance you need, shop around to get the best price. What you already have may be the best rate going, but you won’t know that until you shop around. Put this on your calendar and recheck rates each year.

15. Make a grocery list and go shopping.

Take the time to learn how to inventory your pantry and identify your needs. Write it all down on a list and then go shopping. Buy only what is on the list and avoid off-list temptations. Consider also getting into coupons or signing up for your grocery store’s rewards program. Mindfully planning your grocery spending should help improve your overall nutrition as well as keep your grocery costs capped.

16. Start tracking your spending.

Get a notebook, or a spreadsheet and write down every penny you spend today. This will give you an idea of where your money is going. Keep adding to this journal every day. At the end of a month, you’ll have a clear idea of what spending areas you need to address. Getting apps like Lunch Money (mentioned earlier) or Quicken’s Simplifi are helpful for this as well.

17. Create a budget.

Once you know what you have coming in and going out every month, you can sit down and create a budget to better manage that flow. It doesn’t have to be set in stone, but it does need to be realistic enough to give you a guide to follow as you work through your financial issues. There are literally hundreds of articles on how to create a budget available on the web, but a very simple and basic overview from the Federal Trade Commission is here.

18. Read something about finance.

Education is a powerful tool when it comes to your finances. Today read one article or part of a book about a financial topic that interests you. Maybe you want to know more about investing or debt repayment strategy. Find something relevant to you and learn something new. Do this again another day and keep learning. Never stop.

19. Start contributing to your retirement.

Item 19 on the list of positive money habits is to start contributing to your retirement. Use your budget and your newfound knowledge about what you earn to figure out an amount you can set aside for retirement. Whether it’s in an IRA, a 401(k) or a SEP, you need to be contributing something to retirement. Start with whatever you can afford and increase it gradually. Don’t count on the government to take care of you in your old age. Most of the major brokerages like Schwab or Fidelity will help you open an retirement account and can get you started for just $5 or $10.

20. Start saving money for emergencies, cars, vacations, etc.

Open a savings account (or add to your existing one) and put something in there every month or pay period. Even a little bit is better than nothing. The more you have saved, the better able you’ll be to weather down times or pay cash for things you need. Increase the amount you save as you are able. Many people find money challenges like the 365 day money challenge or the 52 week money challenge a great way to start saving small amount of money a day.

Click here for a nice list of money challenges to try.

21. Take care of others.

Make certain your loved ones are taken care of if something should happen to you. Make sure you have a will and a living will so that your wishes are known. Assign a power of attorney. Set up a trust if necessary. Get disability and life insurance to replace your income if you die or can’t work. Yes, these things cost money but the cost is a fraction of the trouble that will ensue if something happens to you and you are unprepared. Review these things each year to make certain no changes are required.

At the end of these twenty-one days, hopefully you’ve solved some of your financial problems and have a plan to deal with the rest. You’re on your way to better money management habits. If you start to backslide, review these twenty-one days to motivate you to keep going in your new, positive direction.

Jennifer Derrick is a freelance writer, novelist and children’s book author. When she’s not writing Jennifer enjoys running marathons, playing tennis, boardgames and reading pretty much everything she can get her hands on. You can learn more about Jennifer at: https://jenniferderrick.com/.