Nvidia (NASDAQ: NVDA) embodies artificial intelligence (AI) enthusiasm unlike any other growth stock. But what if you already own enough Nvidia, or are simply looking for other opportunities?

A good place to start is by looking at the companies that Nvidia partners with that indirectly benefit from its success.

Three that stick out are Micron Technology (NASDAQ: MU), Vertiv Holdings (NYSE: VRT), and Taiwan Semiconductor Manufacturing (NYSE: TSM). Here’s what makes each stock a great buy now.

Micron is providing a key ingredient in Nvidia’s new GPU

Scott Levine (Micron Technology): Of the many Nvidia partners that have the potential to prosper from a relationship with the AI juggernaut, Micron is a company that should certainly be on growth investors’ radars.

A leader in memory and storage solutions, Micron benefited from the AI industry’s rapid growth in 2023. Its new partnership with Nvidia suggests that the company is extremely well positioned for future growth as the AI market continues to soar.

In February, Micron announced that it had commenced large-scale production of its high capacity memory solution, the High Bandwidth Memory 3E (HBM3E), and it began deliveries of the product in the second quarter. Micron asserts that the HBM3E will help enable “lightning-fast data access for AI accelerators, supercomputers, and data centers.” Nvidia will use the HBM3E in its graphics processing card (GPU), the H200 Tensor Core GPU. It’s not only an increase in performance that makes the HBM3E attractive — it’s also appealing from an economics perspective. Micron lauds the HBM3E as a more cost-effective option, as it uses 30% less power than similar products.

According to Nvidia, the H200 Tensor Core GPU doubles the memory capacity of its previous product, the H100 Tensor Core GPU, and has 1.4 times the bandwidth. With this upgrade in performance, Nvidia is confident that the H200 Tensor Core GPU will further facilitate the development of generative AI and large language models.

The relationship between Micron and Nvidia transcends the recently announced collaboration. In fiscal 2019, for example, Nvidia launched the GeForce RTX graphics card for the gaming market, which relied on Micron’s memory chips.

Vertiv stock still has upside potential

Lee Samaha (Vertiv Holdings): The data center equipment provider’s stock is on an incredible run. Up 549% over the last year and 103% in 2024 alone, investors must be wondering just how much longer the stock has to run, not least because it trades at 41 times estimated 2024 earnings.

Yes, the valuation looks heady, but not if we are only in the very early innings of a multi-year investment cycle in data centers driven by AI-related investment. Vertiv’s digital infrastructure technology (power management, thermal management, rack systems, etc.) is critical to the functioning of data centers, and it’s a solution advisor or consultant partner in the Nvidia partner network.

As such, it’s a vital beneficiary of the boom in spending on AI, and the company’s recent first-quarter earnings demonstrated the strength of the momentum in the trend. Its orders growth was up 60% from the first quarter of 2023, and its book-to-bill ratio was 1.5 times, implying significant revenue growth to come as the company executes on its $6.3 billion backlog.

Wall Street has Vertiv’s free cash flow growing at 22% and 25% in the years after 2024, and if AI spending trends continue, Vertiv should be able to grow into its valuation. If you are bullish on Nvidia, it makes sense to look at Vertiv, too.

The linchpin of chip manufacturing

Daniel Foelber (Taiwan Semiconductor): Taiwan Semi is a bet on sustained demand for chips for consumer electronics, the automotive industry, AI accelerators, and more. In 2023, the chip-making company commanded 61% of global chip-foundry activity.

Nvidia, Broadcom, Advanced Micro Devices, Qualcomm, and others rely on Taiwan Semi to take their proprietary designs and manufacture to extremely precise specifications. Not to put down construction or engineering contractors, but what Taiwan Semi is doing is some of the most complicated manufacturing in the world. Taiwan Semi’s ability to fulfill complex orders is why companies around the world outsource their chip manufacturing to Taiwan.

Investors may want to consider Taiwan Semi as a catch-all way to bet on the rising tides of AI, electrification, data centers, and the general need for more computing power. Taiwan Semi should benefit as long as overall demand is growing. It doesn’t particularly care if AMD is taking market share from Nvidia or vice versa.

Despite its advantages, Taiwan Semi does have some risks — namely competition and the need to simplify supply chains and localize chip manufacturing to reduce geopolitical risk. The CHIPS Act in the U.S., for example, is keen on allocating billions to increase domestic chip production. Taiwan Semi has fabs in the U.S., but it is still primarily manufacturing chips in Asia.

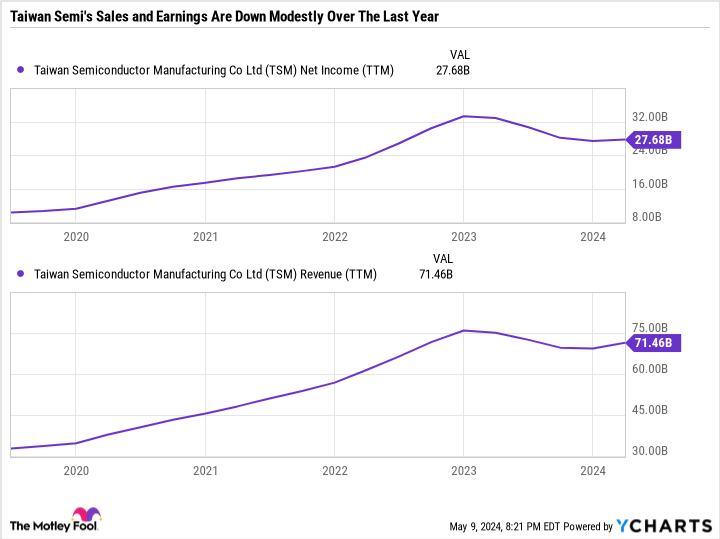

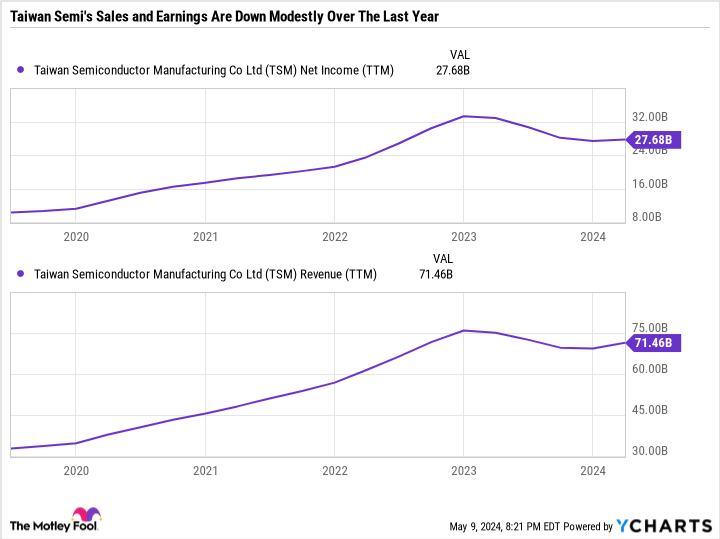

The tailwinds of AI are strong, but that doesn’t mean that growth in the semiconductor industry is a straight line up. Apple, for example, is undergoing a slowdown driven by weak iPhone demand. Taiwan Semi’s sales and earnings have flatlined recently as some of its core markets fall under pressure.

The good news is that analysts expect earnings to recover, with consensus estimates calling for $6.26 in 2024 earnings per share (EPS) and 2025 consensus estimates of $7.86. As a result, Taiwan Semi’s forward price-to-earnings (P/E) ratio is 22.7 compared to its current P/E of 27.2.

Despite being down just 10% from its all-time high, Taiwan Semi is a great value and a balanced buy for investors with the patience to endure the industry’s cyclicality. It also sports a 1.4% dividend yield as a cherry on top of the strong underlying investment thesis.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Daniel Foelber has the following options: long July 2024 $180 calls on Advanced Micro Devices. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

3 Nvidia Partners With Explosive Growth Potential to Buy Now was originally published by The Motley Fool