Financial institution leaders have prioritized innovation and efficiency efforts in 2024 while navigating continually evolving technologies.

This year, bank executives have been tasked with keeping up with generative AI and boosting their cybersecurity efforts in a fraud-ridden environment. And they have done so while maintaining compliance as they await impending regulations.

The year has required a balancing act — and banks have stepped up to the challenge.

Bank Automation News presents 11 bank technology executives who we expect to lead innovation in 2025.

Rohit Dhawan, group director of AI and advanced analytics, Lloyds Bank

Rohit Dhawan is the first to take on the director of AI role at Lloyds Banking Group. He is responsible for scaling Lloyds’s AI capabilities throughout operations while leading its new AI Centre of Excellence.

Dhawan’s appointment is part of the bank’s efforts to accelerate use of digital technologies and data to improve the overall customer experience, according to an Aug. 5 Lloyds release. This year, the bank also added 1,500 technology and data specialists to support these tech-driven efforts.

London-based Lloyds Bank has been using AI to streamline operations and aims to save $901 million in 2024 through tech and AI deployment, according to the bank’s second-quarter earnings report. The $1.1 trillion bank reported that it has nearly 800 AI use cases it plans to deploy in the coming quarters.

Before joining Lloyds, Dhawan served as head of data and AI strategy across the Asia-Pacific region at Amazon Web Services.

Ian Eslick, senior vice president of infrastructure and technology strategy, SoFi

Ian Eslick returned to his tech roots in August when he began work at $27 billion digital lender SoFi, leaving his role at U.S. Bank.

SoFi, one of the largest online lenders for student and unsecured lending, is investing in its product pipeline, especially in a lower rate environment, Chief Executive Anthony Noto said earlier this month at Goldman Sachs Communacopia & Technology Conference 2024, noting that SoFi wants to launch more core products in financial services.

Eslick joins the SoFi team with an innovative and entrepreneurial background. Before his U.S. Bank stint, he founded multiple startups including health care company Vital Labs and data and analytics company Compass Labs, which has raised more than $12 million since its inception, according to Crunchbase.

Steve Hagerman, chief information officer, Truist Financial

Steve Hagerman will join Truist Financial as its CIO in October from Wells Fargo, where he served as CIO for consumer technology since April 2023.

Hagerman was the “right person at the right time for our enterprise technology team,” a Truist spokesperson previously told BAN, noting that selecting a new CIO was a “thorough process.”

His move to the $511 billion Truist follows turbulence on the bank’s leadership team as the bank lost multiple executives in the past year, including former CIO Scott Case, who Hagerman will replace.

“Steve brings 25 years of broad technology experience in the financial services industry to Truist and will be a key driver in our efforts going forward,” CEO Bill Rogers said during Barclays Financial Services Conference earlier this month, noting that the bank is investing in its digital products with efficiency at the forefront.

At Wells Fargo, Hagerman has his hand in the bank’s multi-cloud strategy, approach to generative AI, and AI and machine learning efforts.

Based on his experience, Hagerman is expected to “accelerate how we think about our go-to-market strategy,” Sherry Graziano, head of digital, client experience, and marketing at Truist, told BAN.

Tracy Kerrins, head of consumer technology and gen AI team, Wells Fargo

Tracy Kerrins is leading generative AI efforts as Wells Fargo prioritizes bankwide efficiency efforts.

At the $1.7 trillion bank, Kerrins will identify how AI can be deployed in each area of business, CEO Charlie Scharf said in a July 30 Wells Fargo release.

“Generative AI can help us transform our businesses, improve our customer and client experiences, and enhance the way we work,” he said, noting that Kerrins has experience deploying technology and modernizing operations.

As Kerrins takes on generative AI, the bank has established its own generative AI council to ensure it approaches the technology responsibly.

Prior to her July appointment, Kerrins was the bank’s CIO for consumer technology and enterprise functions, according to the release.

Lindsay Lawrence, chief operating officer, EverBank

The $40 billion, Jacksonville, Fla.-based EverBank is undergoing a digital overhaul during a two-year window led by COO Lindsay Lawrence.

Lawrence is looking to third-party vendors to update manual processes, improve the consumer banking platform and implement an API-first strategy at the regional bank.

Over the next year, the bank plans to continue its modernization strategy with fintech partners including fraud prevention software from Actimize, FIS’ consumer platform Digital One and payment processing system Finzly, Lawrence previously told BAN.

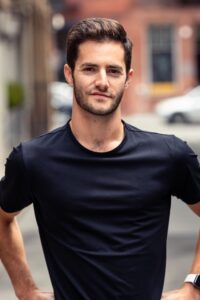

Don Muir, CEO, Arc Technologies

Don Muir, of fintech Arc, plans to expand operations in the United Kingdom and the European Union. The fintech currently provides banking and financial services to small- and medium-sized businesses in the United States.

The fintech recorded 12 times growth in loan origination after the Silicon Valley Bank collapse in March 2023. The banking crisis “was really the catalyst and the inflection point for our business and things haven’t slowed down since that,” Muir told BAN.

Founded in 2021, Arc has raised a total of $181 million in funding from Left Lane Capital, Atalaya Capital and others, according to Crunchbase.

Sathish Muthukrishnan, CIO and data and digital officer, Ally Financial

Sathish Muthukrishnan joined Ally in 2020 as CIO after more than a decade at American Express. At Ally, he has been tasked with developing and deploying AI products and strategies for the $181 billion bank.

Under Muthukrishnan’s leadership, Ally has deployed AI within customer relations and marketing, with the aim of launching one new gen AI feature each month until the end of 2024.

To ensure an ethical approach to gen AI, the bank recently joined the Responsible AI Institute as its first U.S. bank member, according to the institute’s Sept. 18 release.

“Joining the Responsible AI Institute shows our commitment to continue advocating for high standards in the use of AI while also thoughtfully leveraging its potential services,” Muthukrishnan said in the release.

Shruti Patel, chief product officer of business banking, U.S. Bank

As CPO of business banking, Shruti Patel is responsible for delivering an integrated product strategy that connects banking, payments and software for business clients with up to $25 million in revenue.

Under Patel’s leadership, the $657 billion U.S. Bank is developing new technologies, such as AI-driven financial insights for SMBs along with faster and automated payment channels to manage finances.

Before joining U.S. Bank, Patel served as head of global product partnerships and monetization at Shopify and as head of embedded payments and partnerships at JPMorgan Chase.

Carl Slabicki, co-head of global payments, BNY

Carl Slabicki, of BNY Treasury Services, is tasked with keeping up with global payments trends.

Slabicki’s team is responsible for innovating to bridge instant payment capabilities across networks through BNY’s smart routing solution , he told BAN.

The automated smart routing solution determines which payments rail is used for a given transaction. The $428 billion BNY is working to add capabilities to the router to keep up with the global demand for payments rails, he said.

Jameson Troutman, head of product for small business, JPMorgan Chase

Small businesses are looking to their financial institutions to provide digital solutions that will help them keep up with evolving market needs and Jameson Troutman, of $3.9 trillion JPMorgan Chase, is closely monitoring small business trends to innovate based on specific needs within his business unit, he told BAN.

To remain current on digital demands from small business clients, Chase for Business, under Troutman, has recently launched the following products:

- An online payment center;

- A digital invoicing solution;

- An automated payroll solution.

Troutman joined JPMorgan in 2002 as an analyst in the private bank and held roles within Chase Card Services and the Agile Product Office before moving into his current role, according to LinkedIn.

Jess Turner, head of global banking and API, Mastercard

Jess Turner, of Mastercard, is focused on driving the global adoption of open banking.

Open banking applications are on the rise globally. In fact, by 2028 the market value of open banking is expected to reach $75.4 billion, up from $24.7 billion in 2023, according to the Business Research Company.

To boost adoption, especially in the U.S. where the market awaits a decision on the Consumer Financial Protection Bureau’s 1033 ruling, Mastercard is tapping AI and open banking for transaction monitoring, data standardization, and fraud and security efforts, Turner told BAN.

While Turner aims to drive adoption, she recognizes there is hesitation around open banking and is working to educate financial institutions about its benefits including improved access to data and capital through secure APIs.