The End of the Traditional Trading Era: A Neural Network Revolution

In the ever-evolving world of financial markets, a paradigm shift is occurring that’s as dramatic as the transition from open outcry trading pits to electronic platforms. Neural networks are not just enhancing trading – they’re redefining it entirely. Let me show you how these systems achieve superior results in significantly less time while adhering to all traditional trading principles.

AI TUNE

Neural Networks: The New Market Masters

Imagine a trading system that combines the pattern recognition abilities of every successful trader who has ever lived, the processing speed of the world’s fastest computers, and the emotional stability of a zen master. That’s what neural networks bring to modern trading.

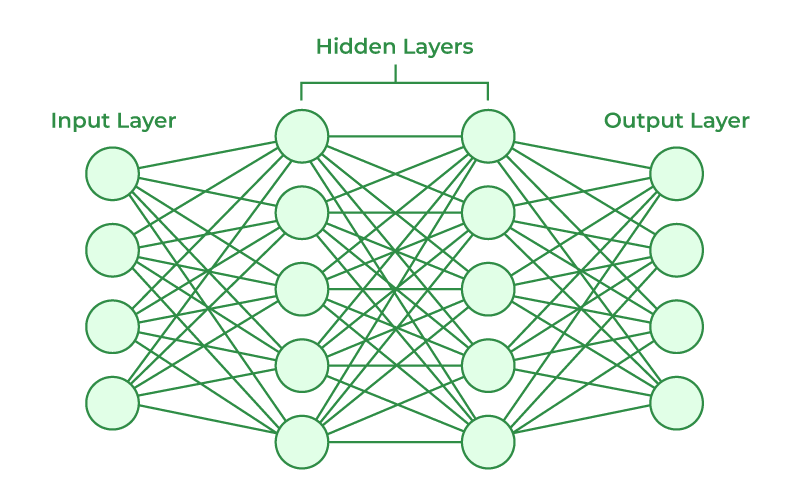

Basic Architecture: The Digital Trader’s Brain

Like a master trader’s mind, neural networks operate through three sophisticated layers:

– Input layer: Think of it as thousands of Bloomberg terminals feeding data simultaneously

– Hidden layers: Similar to having Warren Buffett, George Soros, and Peter Lynch all analyzing the same trade in parallel

– Output layer: The crystallized wisdom of all that analysis into a precise trading decision

Feed-Forward Excellence

Consider this real-world scenario: During the 2020 market crash, while human traders were frozen in panic, well-trained feed-forward networks were identifying buying opportunities by simultaneously processing:

– Historical crash recovery patterns

– Federal Reserve policy implications

– Cross-asset correlations

– Social sentiment indicators

– Market depth analysis

All this happened faster than a trader could say “circuit breaker”!

Recurrent Neural Networks: The Pattern Masters

Here’s where it gets fascinating. RNNs don’t just see patterns; they understand market context like a seasoned trader. For example:

– When crude oil futures are falling while shipping rates are rising

– When bond yields spike but gold doesn’t react

– When options volatility skew suddenly shifts while volume remains constant

These networks can process such complex intermarket relationships in milliseconds, identifying opportunities that human traders might take days to notice.

LSTM Networks: The Market Memory Masters

LSTMs bring another level of sophistication. Imagine catching every major market turn not through gut feeling, but through precise pattern recognition:

– They can detect subtle shifts in market regime changes

– Identify when traditional correlations are breaking down

– Recognize when apparent technical breakouts are likely to fail

Real Performance Metrics

The results speak volumes: A 9% compound annual return with an 18% maximum drawdown represents:

– A Sharpe ratio that would make hedge fund managers envious

– Consistency that human traders rarely achieve

– Risk management that protects capital through various market conditions

Professional Integration Examples:

1. Pairs Trading Enhancement

An LSTM network monitoring mean reversion strategies across hundreds of pairs simultaneously, adjusting position sizes based on correlation strength and market volatility.

2. Options Market Making

Neural networks analyzing options chains across multiple expiries, identifying mispriced contracts while maintaining delta neutrality.

3. Global Macro Trading

RNNs processing data across forex, commodities, and fixed income markets, identifying regime changes before they become apparent to human traders.

The Evolution of Trading

The transition is inevitable. Just as electronic trading made floor traders obsolete, AI-driven systems are revolutionizing how we analyze and execute trades. This isn’t about replacing human judgment entirely; it’s about augmenting it to levels previously unimaginable.

Future Market Dynamics

Picture trading floors where AI systems work alongside human strategists, each focusing on their strengths:

– Networks handling the heavy lifting of data processing

– Humans focusing on macro strategy and risk management

– Hybrid systems combining the best of both worlds

The message is clear: The future of trading belongs to those who understand how to harness these powerful tools. The question isn’t whether to adapt, but how quickly you can integrate these technologies into your trading approach.

Success in this new era requires embracing these changes and understanding how to work alongside these powerful systems. The age of pure discretionary trading is giving way to a new era of algorithmic precision and neural network-driven analysis.