Definition of Order Book

The Order Book is a fundamental component in financial trading that lists buy and sell orders for a particular asset. It organizes these orders by price level, showcasing the market’s supply and demand dynamics. In the context of Forex trading, the Order Book comprises pending or limit orders, such as buy stops, buy limits, sell stops, and sell limits, alongside traders’ position stop losses and take profits. This structured overview provides traders with insights into where market participants intend to execute their trades.

Definition of Position Book

The Position Book, distinct from the Order Book, records opened positions held by traders. It includes both buy and sell positions, reflecting the current trading activity within the market. By visualizing open trades, the Position Book allows traders to identify prevailing trends and situational sentiment based on the distribution of these active positions across various price levels

Why its important to trades?

The Order Book is vital for traders as it provides real-time insights into market sentiment and behaviors. By analyzing the Order Book, traders can detect both support and resistance levels, which can significantly influence their trading strategies. Furthermoe, the Order Book acts as a leading indicator, offering early signals of potential price movements that enable traders to make informed entry and exit decisions.

And the Position Book is equally crucial, as it provides a comprehensive view of traders’ current positions in the market. By studying these open trades, traders can gauge overall market sentiment and predict future price movements based on active positions. This information helps traders manage their risk effectively while aligning their strategies with existing market dynamics.

Advantages of OrderBook and PositionBook

The advantages of the Order Book include enhanced market transparency, as it displays the volume and price of placed orders. This transparency allows traders to identify prevailing demand and supply dynamics that help inform their trading decisions. Additionally, the Order Book enables traders to quickly respond to changing market conditions, optimizing their trading actions to manage their optimal position stop loss and take profits.

And about the the Position Book, It offers significant advantages by showing active trading positions that reflect the real-time attitudes of market participants. This insight allows traders to identify trading trends and make informed decisions regarding their strategies. Moreover, the Position Book aids in risk management by providing a clear depiction of currently held positions, which helps traders gauge potential market movements and analyse the future moves by checking the amount of position in profit or loss. Amazing.

Traders can forecast upward or downward pressure by analyzing the accumulations within both the Order Book and Position Book. For instance, significant clusters of Stop Loss orders often indicate potential price targets, while concentrations of limit orders near the current market price suggest support or resistance levels. Furthermore, the Position Book can reveal clusters of open buy or sell positions that could influence future price movements, offering a glimpse into potential directional pressure.

In summary, you get these:

- Market Sentiment, The market is in the hands of buyers or sellers?

- find the probability support resistance levels (Supply and Demand)

- Find the traders Stop loss and take profit levels, So you know where and how they can be stop hunting!

- Determined the number of traders and positions that are in profit or in loss to predict the next market movements

Let’s dive into the details.

How to Read the market with OrderBook

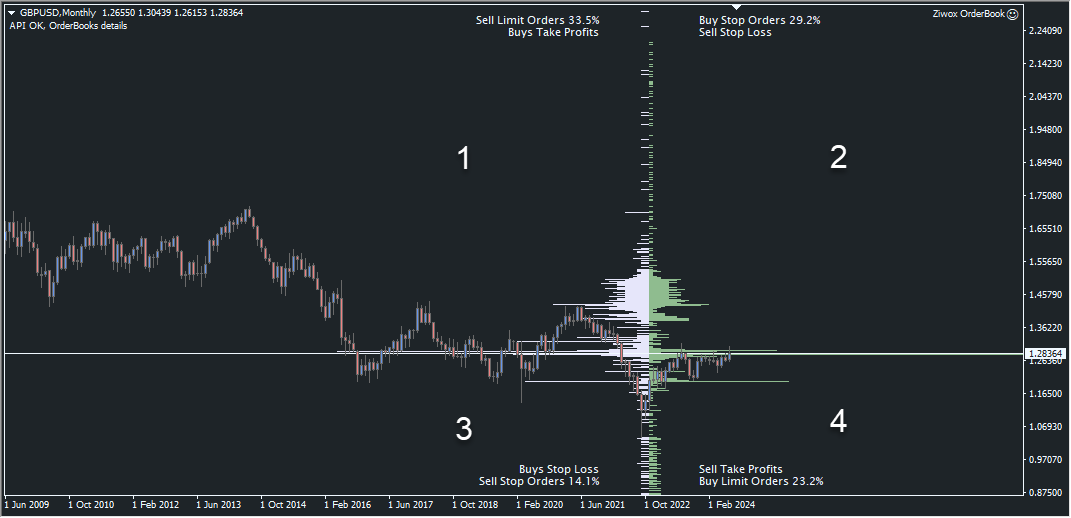

Image 1, GBPUSD OrderBook

Look at the image 1

Order Book, devide the market limit orders in 2 side, left side histogram (White bars) reflects sell orders. right side (Green) are buy limit orders. traders can benefit from its dual histogram representation. Traders can see in which areas there is significant compression of orders to indicating potential support or resistance levels. The relationship between these two histograms provides a comprehensive picture of market dynamic and general market trend.

So, we seperate this 2 side histogram with deeper details.

- Area 1, Sell stop orders including the Buy positions Take profits.

- Area 2, Buy stop orders including the Sell positions stop losses

- Area 3, Sell stop orders including the Buy position stop losses.

- Area 4, Buy limit orders, including Sell position take profits.

By looking deeper you can find important levels for traders. Peaks consist of more volumes and placing orders and valleys consist of fewer orders set by traders. levels with longer lengths have more placed orders.

Particular, all peaks correspond to price peaks on the chart. You shoul search, like a detective to find clues!

Look at the image 1, and focuse to the 1.16555 price area. A huge number of order have been placeds in this levels. Is it interesting that this number is exactly in the levels that is observed on February 1st with a very strong shadow??

Is this interesting that this huge amount of buy limit orders is exactly at the same level of February 1st? looking at the big shadow tha pulled up with a strong demand?

These huge number of orders, could be our Support and ressistance levels. They are liquidity and acte like a magnet for price.

The attractive advantage of this part is that you know where are lots of other people’s stoplosses. And this point will help you to know when and at what price you may be stop hunting 🙂 Try not to

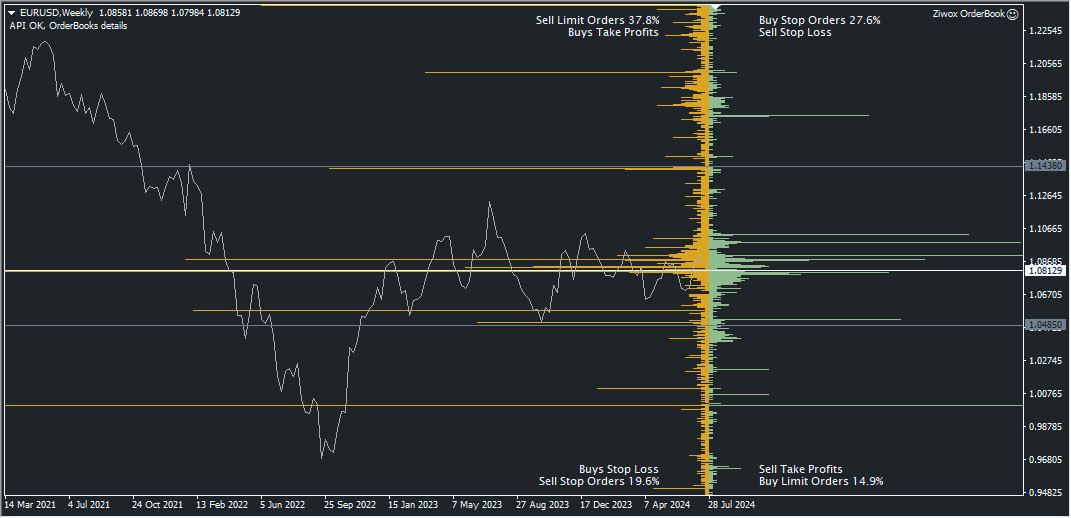

Image 2, EUYRUSD OrderBook

Lets describe it, by more example. look at the image 2. Accumulation of buying orders from 1.08129 to the 1.0485 levels along with it placing these buy orders stop loss on the 1.0485 area. There is a beautiful match with the price ceiling and floor in the chart. or find the 1.14380 price levels. If you are familiar with the ICT trading method, you will find the Drop,base,Dropp trend on that levels. It is exactly equal to huge sell limit orders there.

Now Lets dive deep into thee PositionBook.

How to Read the market with PositionBook

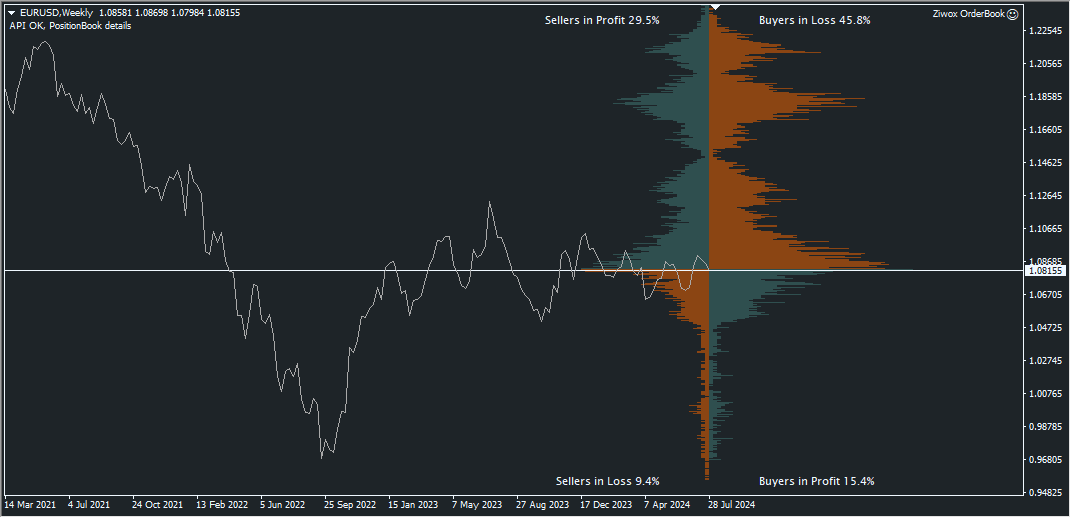

Image 3, EURUSD PositionBook

In the PositionBook, you don’t just see the number of positions. What does it mean when there are many buyers, bellow the current market price? it showing you, how many buyers are profitable and all buy positions above the market price are in loss. How does this help us? Think that all these losses are going to be closed soon, or on the contrary, If there are many selling positions in profit. Sell positions are closed in profit and increase the price becasue close a sell position equal to a new buy position. You get the point? Right?

How to USE:

Market Sentiment:

To derive market sentiment from the Order Book, traders can analyze the volume of buy and sell orders. An increased volume of buy orders typically indicates bullish sentiment, while greater volumes of sell orders suggest bearish sentiment. Additionally, by examining key clusters of pending limit orders, traders can determine significant support and resistance levels, indicating where prices may stabilize or reverse in the market

Support and Resistance Levels

Support and resistance levels can be identified using the volume of orders within the Order Book. For instance, substantial clusters of buy orders at specific price points may indicate strong support, suggesting that the price is less likely to fall below that level. Conversely, clusters of sell orders indicate resistance, where prices may struggle to rise above that point. These levels help traders establish where they might enter or exit trades based on anticipated price behavior1

Finding Optimal Levels for Stop Loss and Take Profit

When it comes to setting stop loss and take profit levels, traders should utilize insights from the Order Book. It is advisable to place stop losses beyond significant support or resistance levels to avoid being prematurely triggered during potential stop hunting. Moreover, analyzing the order flow can reveal areas where numerous stop losses are clustered, and setting levels a reasonable distance beyond these targets can protect traders from being hunted. By employing sound strategies based on historical Order Book data, traders can improve the effectiveness of their stop loss and take profit levels, thus managing their risks better.

Losing Trades: Analyzing clusters of losing trades in the right order book can suggest areas where price may bounce back upward once those positions are closed.

Winning Trades: Conversely, a substantial presence of winning trades may indicate a potential market reversal, as rapid closures could push prices in the opposite direction