Updated on September 19th, 2024 by Bob Ciura

Spreadsheet data updated daily

Master Limited Partnerships – or MLPs, for short – are some of the most misunderstood investment vehicles in the public markets. And that’s a shame, because the typical MLP offers:

- Tax-advantaged income

- High yields well in excess of market averages

- The bulk of corporate cash flows returned to shareholders through distributions

An example of a ‘normal’ MLP is an organization involved in the midstream energy industry. Midstream energy companies are in the business of transporting oil, primarily though pipelines. Pipeline companies make up the vast majority of MLPs.

Since MLPs widely offer high yields, they are naturally appealing for income investors. With this in mind, we created a full downloadable list of nearly 100 MLPs in our coverage universe.

You can download the Excel spreadsheet (along with relevant financial metrics like dividend yield and payout ratios) by clicking on the link below:

This comprehensive article covers MLPs in depth, including the history of MLPs, unique tax consequences and risk factors of MLPs, as well as our 7 top-ranked MLPs today.

The table of contents below allows for easy navigation of the article:

Table of Contents

The History of Master Limited Partnerships

MLPs were created in 1981 to allow certain business partnerships to issue publicly traded ownership interests.

The first MLP was Apache Oil Company, which was quickly followed by other energy MLPs, and then real estate MLPs.

The MLP space expanded rapidly until a great many companies from diverse industries operated as MLPs – including the Boston Celtics basketball team.

One important trend over the years, is that energy MLPs have grown from being roughly one-third of the total MLP universe to containing the vast majority of these securities.

Moreover, the energy MLP universe has evolved to be focused on midstream energy operations. Midstream partnerships have grown to be roughly half of the total number of energy MLPs.

MLP Tax Consequences

Master limited partnerships are tax-advantaged investment vehicles. They are taxed differently than corporations. MLPs are pass-through entities. They are not taxed at the entity level.

Instead, all money distributed from the MLP to unit holders is taxed at the individual level.

Distributions are ‘passed through’ because MLP investors are actually limited partners in the MLP, not shareholders. Because of this, MLP investors are called unit holders, not shareholders.

And, the money MLPs pay out to unit holders is called a distribution (not a dividend).

The money passed through from the MLP to unit holders is classified as either:

- Return of Capital

- Ordinary Income

MLPs tend to have lots of depreciation and other non-cash charges. This means they often have income that is far lower than the amount of cash they can actually distribute. The cash distributed less the MLPs income is a return of capital.

A return of capital is not technically income, from an accounting and tax perspective. Instead, it is considered as the MLP actually returning a portion of its assets to unit holders.

Now here’s the interesting part… Returns of capital reduce your cost basis. That means taxes for returns of capital are only due when you sell your MLP units. Returns of capital are tax-deferred.

Note: Return of capital taxes are also due in the event that your cost basis is less than $0. This only happens for very long-term holding, typically around 10 years or more.

Each individual MLP is different, but on average an MLPs distribution is usually around 80% to 90% a return of capital, and 10% to 20% ordinary income.

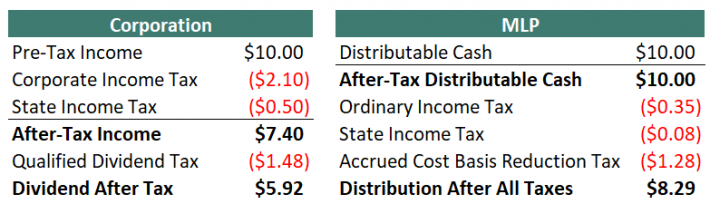

This works out very well from a tax perspective. The images below compare what happens when a corporation and an MLP each have the same amount of cash to send to investors.

Note 1: Taxes are never simple. Some reasonable assumptions had to be made to simplify the table above. These are listed below:

- Corporate federal income tax rate of 21%

- Corporate state income tax rate of 5%

- Qualified dividend tax rate of 20%

- Distributable cash is 80% a return of capital, 20% ordinary income

- Personal federal tax rate of 22% less 20% for passive entity tax break

(19.6% total instead of 22%) - Personal state tax rate of 5% less 20% for passive entity tax break

(4% total instead of 5%) - Long-term capital gains tax rate of 20% less 20% for passive entity tax break

(16% total instead of 20%)

Note 2: The 20% passive income entity tax break will expire in 2025.

Note 3: In the MLP example, if the maximum personal tax rate of 37% is used, the distribution after all taxes is $8.05.

Note 4: In the MLP example, the accrued cost basis reduction tax is due when the MLP is sold, not annually come tax time.

As the tables above show, MLPs are far more efficient vehicles for returning cash to shareholders relative to corporations. Additionally, in the example above $9.57 out of $10.00 distribution would be kept by the MLP investor until they sold because the bulk of taxes are from returns of capital and not due until the MLP is sold.

Return of capital and other issues discussed above do not matter when MLPs are held in a retirement account.

There is a different issue with holding MLPs in a retirement account, however. This includes 401(k), IRA, and Roth IRA accounts, among others.

When retirement plans conduct or invest in a business activity, they must file separate tax forms to report Unrelated Business Income (UBI) and may owe Unrelated Business Taxable Income (UBTI). UBTI tax brackets go up to 37% (the top personal rate).

MLPs issue K-1 forms for tax reporting. K-1s report business income, expense, and loss to owners. Therefore, MLPs held in retirement accounts may still qualify for taxes.

If UBI for all holdings in your retirement account is over $1,000, you must have your retirement account provider (typically, your brokerage) file Form 990-T.

You will want to file form 990-T as well if you have a UBI loss to get a loss carryforward for subsequent tax years. Failure to file form 990-T and pay UBIT can lead to severe penalties.

Fortunately, UBIs are often negative. It is a fairly rare occurrence to owe taxes on UBI.

The subject of MLP taxation can be complicated and confusing. Hiring a tax professional to aid in preparing taxes is a viable option for dealing with the complexity.

The bottom line is this: MLPs are tax-advantaged vehicles that are suited for investors looking for current income. It is fine to hold them in either taxable or non-taxable (retirement) accounts.

Since retirement accounts are already tax-deferred, holding MLPs in taxable accounts allows you to ‘get credit’ for the full effects of their unique structure.

4 Advantages & 6 Disadvantages of Investing in MLPs

MLPs are a unique asset class. As a result, there are several advantages and disadvantages to investing in MLPs. Many of these advantages and disadvantages are unique specifically to MLPs.

Advantages of MLPs

Advantage #1: Lower taxes

MLPs are tax-advantaged securities, as discussed in the “Tax Consequences” section above. Depending on your individual tax bracket, MLPs are able to generate around 40% more after-tax income for every pre-tax dollar they decide to distribute, versus Corporations.

Advantage #2: Tax-deferred income through returns of capital

In addition to lower taxes in general, 80% to 90% of the typical MLPs distributions are classified as returns of capital. Taxes are not 0wed (unless cost basis falls below 0) on return of capital distributions until the MLP is sold.

This creates the favorable situation of tax-deferred income.

Tax-deferred income is especially beneficial for retirees as return on capital taxes may not need to be paid throughout retirement.

Advantage #3: Diversification from other asset classes

Investing in MLPs provides added diversification in a balanced portfolio. Diversification can be measured by the correlation in return series between asset classes.

MLPs are excellent diversifiers, having either a near zero or negative correlation to corporate bonds, government bonds, and gold.

Additionally, they have a correlation coefficient of less than 0.5 to both REITs and the S&P 500. This makes MLPs an excellent addition to a diversified portfolio.

Advantage #4: Typically very high yields

MLPs tend to have high yields far in excess of the broader market. As of this writing, the S&P 500 yields ~2.1%, while the Alerian MLP ETF (AMLP) yields over 25%. Many individual MLPs have yields above 10%.

Disadvantages of MLPs

Disadvantage #1: Complicated tax situation

MLPs can create a headache come tax season. MLPs issue K-1’s and are generally more time-consuming and complicated to correctly calculate taxes than ‘normal’ stocks.

Disadvantage #2: Potential additional paperwork if held in a retirement account

In addition, MLPs create extra paperwork and complications when invested through a retirement account because they potentially create unrelated business income (UBI). See the “Tax Consequences” section above for more on this.

Disadvantage #3: Little diversification within the MLP asset class

While MLPs provide significant diversification versus other asset classes, there is little diversification within the MLP structure.

The vast majority of publicly traded MLPs are oil and gas pipeline businesses. There are some exceptions, but in general MLP investors are investing in energy pipelines and not much else.

Because of this, it would be unwise to allocate all or a majority of one’s portfolio to this asset class.

Disadvantage #4: Incentive Distribution Rights (IDRs)

MLP investors are limited partners in the partnership. The MLP form also has a general partner.

The general partner is usually the management and ownership group that controls the MLP, even if they own a very small percentage of the actual MLP.

Incentive Distribution Rights, or IDRs, are used to ‘incentivize’ the general partner to grow the MLP.

IDRs typically allocate greater percentages of cash flows to go to the general partner (and not to the limited partners) as the MLP grows its cash flows.

This reduces the MLPs ability to grow its distributions, putting a handicap on distribution increases.

It should be noted that not all MLPs have IDRs, but the majority do.

Disadvantage #5: Elevated risk of distribution cuts due to high payout ratios

One of the big advantages of investing in MLPs is their high yields. Unfortunately, high yields very often come with high payout ratios.

Most MLPs distribute nearly all of the cash flows they make to unit holders. In general, this is a positive.

However, it creates very little room for error.

The pipeline business is generally stable, but if cash flows decline unexpectedly, there is almost no margin of safety at many MLPs. Even a short-term disturbance in business results can necessitate a reduction in the distribution.

Disadvantage #6: Growth Through Debt & Share Issuances

Since MLPs typically distribute virtually all of their cash flows as distributions, there is very little money left over to actually grow the partnership.

And most MLPs strive to grow both the partnership, and distributions, over time. To do this, the MLP’s management must tap capital markets by either issuing new units or taking on additional debt.

When new units are issued, existing unit holders are diluted; their percentage of ownership in the MLP is reduced.

When new debt is issued, more cash flows must be used to cover interest payments instead of going into the pockets of limited partners through distributions.

If an MLPs management team starts projects with lower returns than the cost of their debt or equity capital, it destroys unit holder value. This is a real risk to consider when investing in MLPs.

The 7 Best MLPs Today

The 7 best MLPs are ranked and analyzed below using expected total returns from the Sure Analysis Research Database. Expected total returns consist of 3 elements:

- Return from change in valuation multiple

- Return from distribution yield

- Return from growth on a per-unit basis

Investors should note that the top MLPs list was not screened on a qualitative assessment of a company’s dividend risk. The focus is expected annual returns over the next five years.

That said, MLPs with current distribution yields below 2% were not considered. This screen makes the list more attractive to income investors.

Continue reading for detailed analysis on each of our top MLPs, ranked according to expected 5-year annual returns.

MLP #7: AllianceBernstein Hldg. LP (AB)

- 5-year expected annual returns: 10.3%

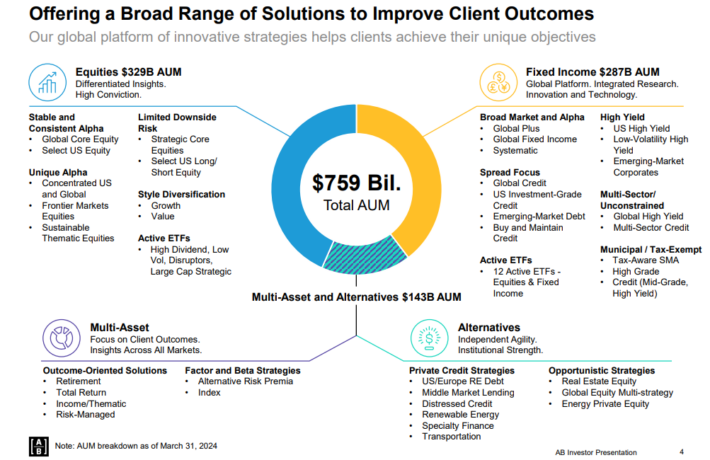

AllianceBernstein Hldg. L.P. is an asset manager with an emphasis on fixed income investments, but offers diversified investment solutions for institutional investors, private wealth clients, and retail investors.

AllianceBernstein has total assets under management of more than $750 billion.

Source: Investor Presentation

AllianceBernstein L.P. reported financial and operating results for the quarter ended June 30, 2024. The company achieved a GAAP net income per unit of $0.99 and an adjusted net income per unit of $0.71, with a cash distribution per unit of $0.71.

Key financial results for the quarter showed that net revenues reached $1.03 billion, reflecting a 1.9% increase compared to the same quarter in 2023 but a 6.9% decrease from the previous quarter.

Operating income for the quarter was $199.3 million, representing a 5.6% increase year-over-year but a 17.6% decrease from the prior quarter.

Click here to download our most recent Sure Analysis report on AB (preview of page 1 of 3 shown below):

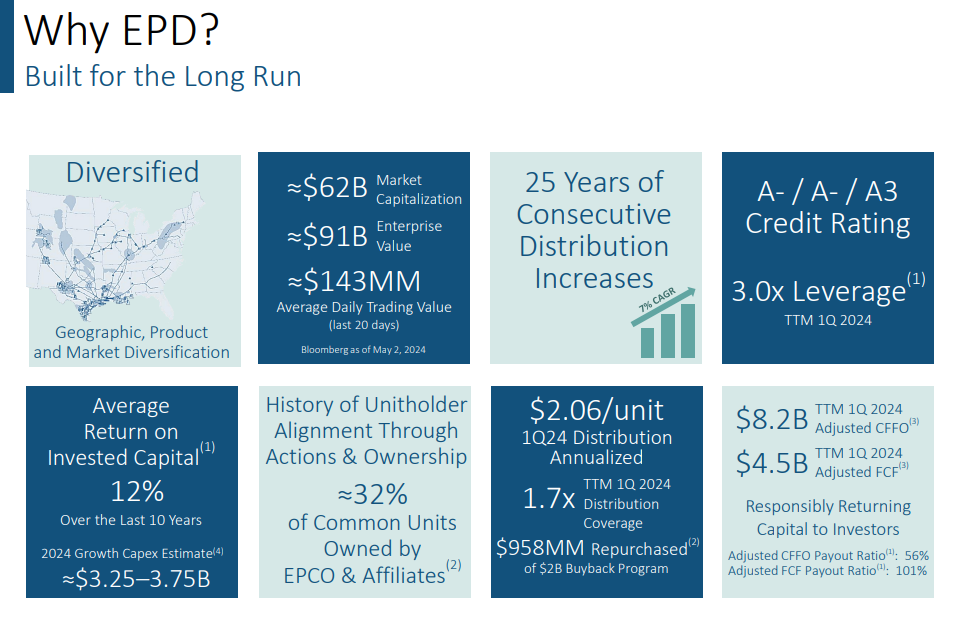

MLP #6: Enterprise Products Partners LP (EPD)

- 5-year expected annual returns: 10.6%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

Enterprise Products Partners reported second-quarter 2024 earnings with an EPS of $0.64, missing estimates by $0.03, and revenue of $13.48 billion, which fell short by $787.40 million despite a 26.59% year-over-year increase.

Net income attributable to common unitholders was $1.4 billion, a 12% increase compared to $1.3 billion in the second quarter of 2023. Distributable Cash Flow (DCF) rose to $1.8 billion, up from $1.7 billion in the same period last year, providing 1.6 times coverage of the declared distribution. Enterprise increased its quarterly distribution by 5% to $0.525 per unit and repurchased approximately $40 million of its common units.

The company’s Adjusted Cash Flow from Operations (CFFO) was $2.1 billion, up from $1.9 billion in the second quarter of 2023, with an annualized Adjusted CFFO of $8.4 billion.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

MLP #5: Hess Midstream LP (HESM)

- 5-year expected annual returns: 12.4%

Hess Midstream LP owns and operates midstream assets primarily located in the Bakken and Three Forks Shale plays in North Dakota. It provides oil, gas and water midstream services to Hess and third-party customers in the U.S.

Hess Midstream has long-term commercial contracts, which extend through 2033. Its contracts are 100% fee-based and minimize the exposure of the company to commodity prices. About 85% of the revenues of Hess Midstream are protected by minimum-volume commitments in 2024.

Source: Investor Presentation

In late July, Hess Midstream reported (7/31/24) financial results for the second quarter of fiscal 2024. Throughput volumes grew 17% for gas processing, 17% for oil terminaling and 43% for water gathering over the prior year’s quarter, primarily thanks to higher production, higher gas capture and higher system utilization.

As a result, revenue grew 13% and earnings-per-share grew 18%, from $0.50 to $0.59.

Management reiterated its positive guidance for the full year thanks to strong business momentum in all segments. It expects 12.5% growth of adjusted EBITDA this year, adjusted free cash flow of $675-$725 million and at least 5% annual growth of distributions until 2026.

Click here to download our most recent Sure Analysis report on HESM (preview of page 1 of 3 shown below):

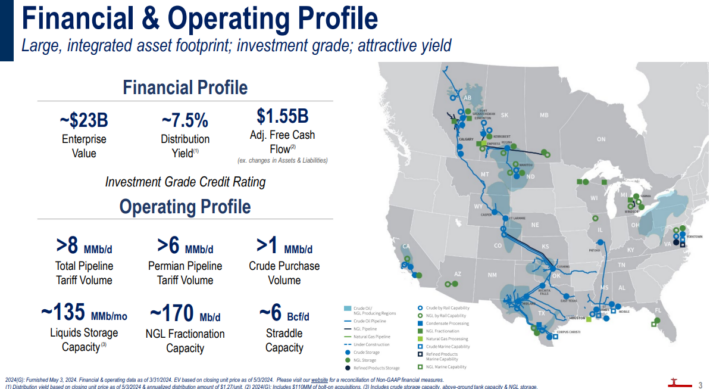

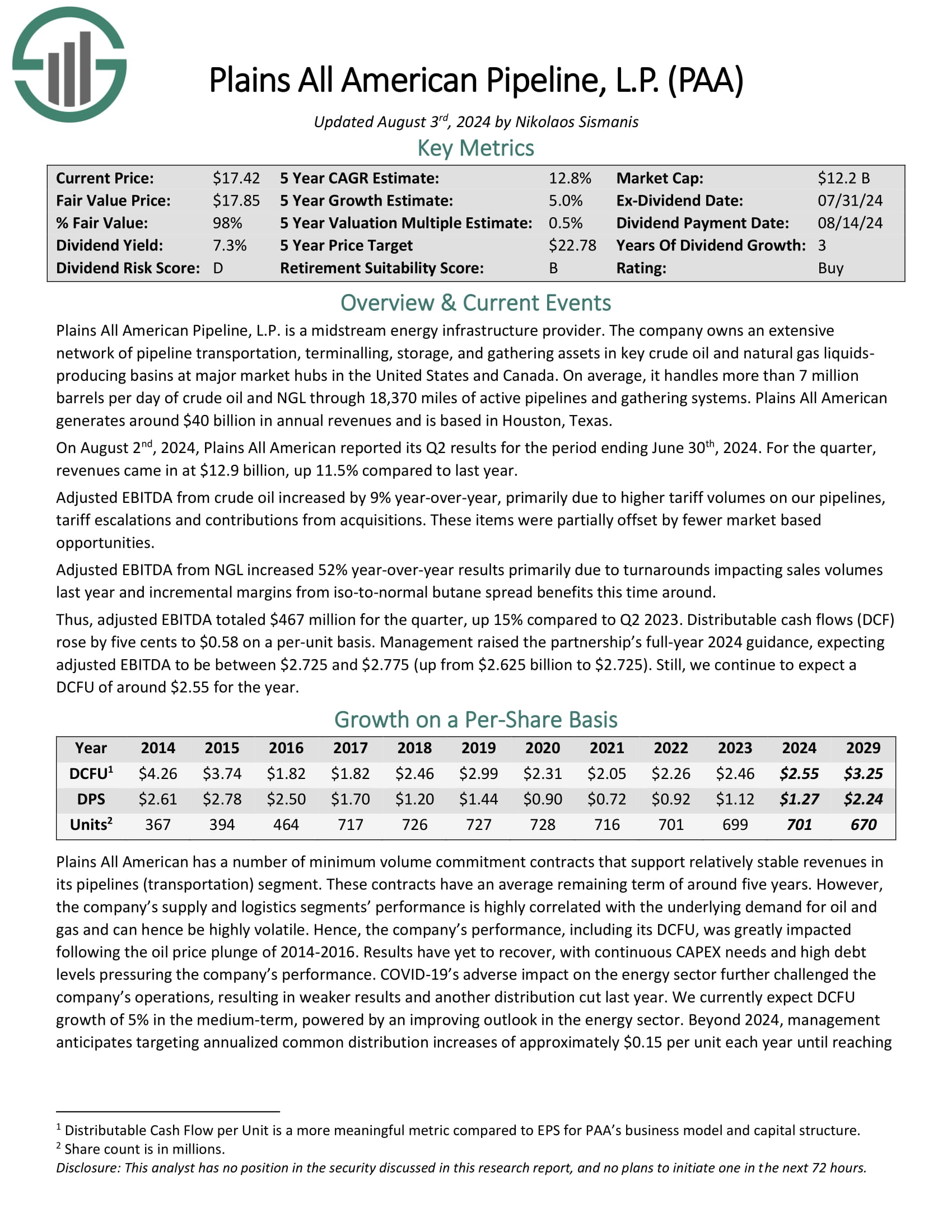

MLP #4: Plains All American Pipeline LP (PAA)

- 5-year expected annual returns: 12.5%

Plains All American Pipeline, L.P. is a midstream energy infrastructure provider. The company owns an extensive network of pipeline transportation, terminaling, storage, and gathering assets in key crude oil and natural gas liquids-producing basins at major market hubs in the United States and Canada.

Source: Investor Presentation

On August 2nd, 2024, Plains All American reported its Q2 results for the period ending June 30th, 2024. For the quarter, revenues came in at $12.9 billion, up 11.5% compared to last year.

Adjusted EBITDA from crude oil increased by 9% year-over-year, primarily due to higher tariff volumes on our pipelines, tariff escalations and contributions from acquisitions. These items were partially offset by fewer market based opportunities.

Adjusted EBITDA from NGL increased 52% year-over-year results primarily due to turnarounds impacting sales volumes last year and incremental margins from iso-to-normal butane spread benefits this time around. Adjusted EBITDA totaled $467 million for the quarter, up 15% compared to Q2 2023.

Click here to download our most recent Sure Analysis report on PAA (preview of page 1 of 3 shown below):

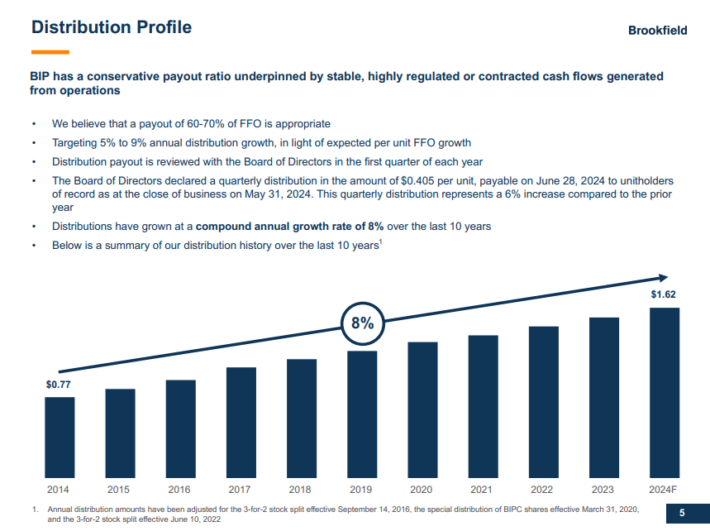

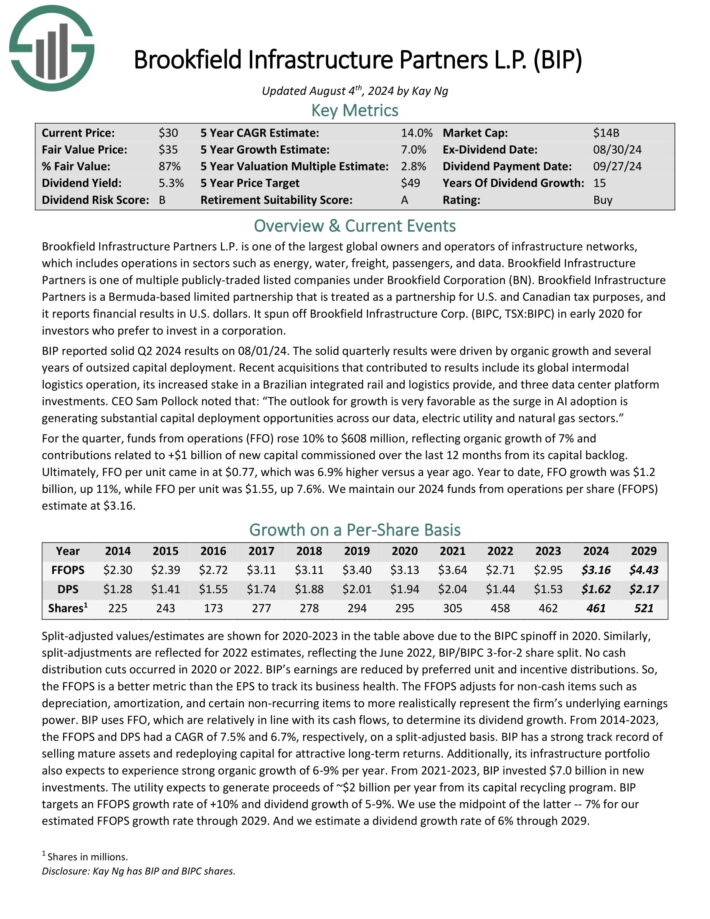

MLP #3: Brookfield Infrastructure Partners LP (BIP)

- 5-year expected annual returns: 12.5%

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data.

Brookfield Infrastructure Partners is one of four publicly-traded listed partnerships that is operated by Brookfield Asset Management (BAM).

BIP has delivered 8% compound annual distribution growth over the past 10 years.

Source: Investor Presentation

BIP reported solid Q2 2024 results on 08/01/24. The solid quarterly results were driven by organic growth and several years of outsized capital deployment. Recent acquisitions that contributed to results include its global intermodal logistics operation, its increased stake in a Brazilian integrated rail and logistics provide, and three data center platform investments.

For the quarter, funds from operations (FFO) rose 10% to $608 million, reflecting organic growth of 7% and contributions related to +$1 billion of new capital commissioned over the last 12 months from its capital backlog. Ultimately, FFO per unit came in at $0.77, which was 6.9% higher versus a year ago.

Click here to download our most recent Sure Analysis report on Brookfield Infrastructure Partners (preview of page 1 of 3 shown below):

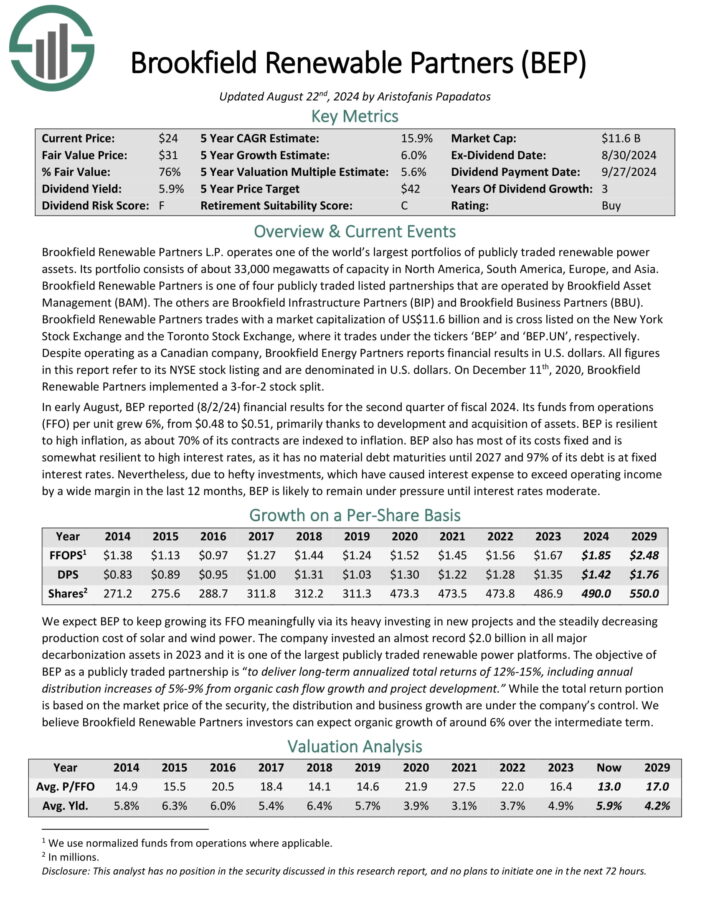

MLP #2: Brookfield Energy Partners LP (BEP)

- 5-year expected annual returns: 13.6%

Brookfield Renewable Partners L.P. operates one of the world’s largest portfolios of publicly traded renewable power

assets. Its portfolio consists of about 33,000 megawatts of capacity in North America, South America, Europe, and Asia.

Brookfield Renewable Partners is one of four publicly traded listed partnerships that are operated by Brookfield Asset Management (BAM). The others are Brookfield Infrastructure Partners (BIP) and Brookfield Business Partners (BBU).

Source: Investor Presentation

In early August, BEP reported (8/2/24) financial results for the second quarter of fiscal 2024. Its funds from operations (FFO) per unit grew 6%, from $0.48 to $0.51, primarily thanks to development and acquisition of assets. BEP is resilient to high inflation, as about 70% of its contracts are indexed to inflation.

BEP also has most of its costs fixed and is somewhat resilient to high interest rates, as it has no material debt maturities until 2027 and 97% of its debt is at fixed interest rates.

Click here to download our most recent Sure Analysis report on Brookfield Renewable Partners (preview of page 1 of 3 shown below):

MLP #1: NextEra Energy Partners (NEP)

- 5-year expected annual returns: 18.8%

NextEra Energy Partners was formed in 2014 as Delaware Limited Partnership by NextEra Energy to own, operate, and acquire contracted clean energy projects with stable, long-term cash flows.

NextEra Energy Partners operates contracted renewable generation assets consisting of wind and solar projects across the United States. The company also operates contracted natural gas pipelines in Texas.

NextEra Energy Partners, LP reported second-quarter 2024 financial results, delivering a solid financial performance with net income attributable to NextEra Energy Partners of $62 million. The company also reported adjusted EBITDA of $560 million and cash available for distribution (CAFD) of $220 million.

NextEra Energy Partners projects 5% to 8% growth per year in limited partner distributions per unit from the fourth-quarter 2023 distribution base of $3.52 per unit, with a target of 6% annual growth through at least 2026.

Click here to download our most recent Sure Analysis report on NEP (preview of page 1 of 3 shown below):

MLP ETFs, ETNs, & Mutual Funds

There are 3 primary ways to invest in MLPs:

- By investing in units of individual publicly traded MLPs

- By investing in a MLP ETF or mutual fund

- By investing in a MLP ETN

Note: ETN stands for ‘exchange traded note’

The difference between investing directly in a company (normal stock investing) versus investing in a mutual fund or ETF is very clear. It is simply investing in one security versus a group of securities.

ETNs are different. Unlike mutual funds or ETFs, ETNs don’t actually own any underlying shares or units of real businesses.

Instead, ETNs are financial instruments backed by the financial institution (typically a large bank) that issued them. They perfectly track the value of an index. The disadvantage to ETNs is that they expose investors to the possibility of a total loss if the backing institution were to go bankrupt.

The advantage to investing in a MLP ETN is that distribution income is tracked, but paid via a 1099. This eliminates the tax disadvantages of MLPs (no K-1s, UBTI, etc.). This unique feature may appeal to investors who don’t want to hassle with a more complicated tax situation. The J.P. Morgan Alerian MLP ETN makes a good choice in this case.

Purchasing individual securities is preferable for many, as it allows investors to concentrate on their best ideas. But ETFs have their place as well, especially for investors looking for diversification benefits.

Final Thoughts

Master Limited Partnerships are a misunderstood asset class. They offer diversification, tax-advantaged and tax-deferred income, high yields, and have historically generated excellent total returns.

You can download your free copy of all MLPs by clicking on the link below:

The asset class is likely under-appreciated because of its more complicated tax status.

MLPs are generally attractive for income investors, due to their high yields.

As always, investors need to conduct their own due diligence regarding the unique tax effects and risk factors before purchasing MLPs.

The MLPs on this list could be a good place to find long-term buying opportunities among the beaten-down MLPs.

Additionally, MLPs are not the only way to find high levels of income. The following lists contain many more stocks that regularly pay rising dividends.

- The Dividend Aristocrats List: 66 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].