Updated on July 16th, 2024 by Bob Ciura

Data updated daily

Dividends are the most common method that a company can use to return capital to shareholders. Dividend growth investors often place significant emphasis on dividend yields and dividend growth as a result.

Naturally, dividend growth investors are attracted to high-quality stocks such as the Dividend Aristocrats, an exclusive group of stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

However, there are additional ways for companies to create value for shareholders.

In addition to dividends, share repurchases are also an important part of a healthy capital return program. Debt reduction should also be welcomed by investors.

Related: Learn more about share repurchases in the video below.

There is a single financial metric that incorporates each of these factors (dividend payments, share repurchases, and debt reduction). It is called shareholder yield – and stocks with high shareholder yields can make fantastic long-term investments.

With that in mind, the High Shareholder Yield Stocks List that you can download below contains stocks with positive shareholder yields, meaning that they offer a dividend, buybacks, and/or debt reduction of some kind.

Keep reading this article to learn more about the merits of investing in stocks with above-average shareholder yields.

What Is Shareholder Yield?

To invest in the stocks with the highest shareholder yields, you have to find them first. The High Shareholder Yield Stocks List helps identify stocks with high shareholder yields.

Shareholder yield measure how much money a company is returning to its shareholder through dividend payments, share repurchases, and debt reduction.

It is expressed as a percent, and can be interpreted as the answer to the following question: ‘How much money will be returned to me through dividend payments, share repurchases, and debt reduction if I buy $100 of company stock?’

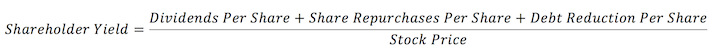

Mathematically, shareholder yield is defined as follows:

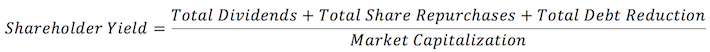

Alternatively, shareholder yield can be calculated using company-wide metrics (instead of per-share metrics).

The common sense interpretation of shareholder-yield is the percent of your invested money that is devoted to activities that are quantitatively shareholder-friendly (dividend payments, share repurchases, and debt reductions).

How To Use The High Shareholder Yield List To Find Dividend Investment Ideas

Having an Excel document full of stocks that have high shareholder yields can be very useful.

However, the true power of such a document can only be unlocked when its user has a rudimentary knowledge of how to use Microsoft Excel.

With that in mind, this section will provide a tutorial of how to implement two additional screens (in addition to the screen for high shareholder yields) to the High Shareholder Yield Spreadsheet List.

The first screen that will be implemented is a screen for stocks that are trading at a forward price-to-earnings ratio less than 16.

Step 1: Download the High Shareholder Yield Spreadsheet List at the link above.

Step 2: Click on the filter icon at the top of the ‘PE Ratio’ column, as shown below.

Step 3: Change the filter setting to ‘Less Than’ and input ’16’ into the field beside it.

This will filter for stocks with high shareholder yields and forward price-to-earnings ratios below 16.

The next filter that will be implemented is for stocks with market capitalizations above $10 billion (which are called large capitalization – or ‘large cap’ – stocks).

Step 1: Download the High Shareholder Yield Spreadsheet List at the link above.

Step 2: Click on the filter icon at the top of the ‘Market Cap’ column, as shown below.

Step 3: Change the filter setting to ‘Greater Than’ and input 10000 into the next field. Since the market capitalization column is measured in millions of dollars, this will filter for stocks with market capitalizations higher than $10 billion (which represent the ‘large cap’ universe of stocks).

The remaining stocks in this Excel sheet are those with high shareholder yields and market capitalizations of $10 billion or higher.

Now that you have an understanding of how to use the High Shareholder Yield Stocks List, the remainder of this article will explain how to calculate & interpret shareholder yield and will also explain some of the benefits of investing in securities with high shareholder yields.

Why Invest In Stocks With High Shareholder Yields?

There are a number of benefits to investing in stocks with high shareholder yields.

The first and perhaps most obvious benefit to investing in high shareholder yield stocks is the knowledge that the company’s management has its shareholders’ best interests at heart.

A high shareholder yield indicates that dividend payments, share repurchases, and debt reductions are a top priority for management.

In other words, high shareholder yields are correlated with a corporate culture that emphasizes shareholder well-being.

The second and more important benefit to investing in stocks with high shareholder yields is that they have a proven record of delivering outsized total returns over meaningful periods of time.

This can be seen by looking at stock market indices that focus on stocks with high shareholder yields.

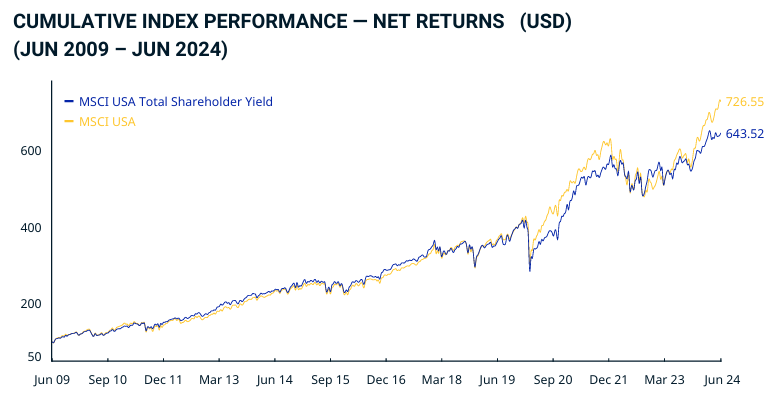

For instance, the image below compares the returns of the MSCI USA Total Shareholder Yield Index to a broader universe of domestic stocks – the MSCI USA Index.

Source: MSCI USA Total Shareholder Yield Fact Sheet

Since inception, the MSCI USA Total Shareholder Yield Index has outperformed the broader stock market, delivering annualized returns of 7.61% per year compared with 7.15% for the MSCI USA Index.

Why is this especially impressive?

Well, it is because the past 5 years have witnessed a robust bull market and a corresponding increase in asset prices.

A significant component of shareholder yield is share repurchases. Share repurchases occur when a company buys back its stock for cancellation, increasing the part ownership of each continuing shareholders.

Importantly, share repurchases are significantly more effective during bear markets than during bull markets because the same dollar value of share repurchases can buy back a larger amount of company stock.

This common-sense characteristic of high shareholder yield stocks – that they should outperform during recessions – is an admirable trait and should be appreciated by investors who incorporate shareholder yield into their investment strategy.

But it is also impressive that these stocks have also outperformed in the past 5 years.

Other Sources of Compelling Investment Ideas

Stocks with high shareholder yields often make fantastic investment opportunities.

However, they are not the only signs that a company’s management has the best interest of its shareholders at heart. Moreover, shareholder yields are only one (there are many others) of the quantitative signals that a stock may deliver market-beating performance over time.

One of our preferred signals for the shareholder-friendliness and future prospects of a company is a long dividend history. A lengthy history of steadily increasing dividend payments is indicative of a durable competitive advantage and a recession-proof business model.

With that in mind, the following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Investors can also look to the dividend portfolios of successful, institutional investors for high-quality dividend investment ideas.

Large portfolio managers with $100 million or more of assets under management must disclose their holdings in quarterly 13F filings with the U.S. Securities & Exchange Commission.

Sure Dividend has analyzed the equity portfolios of the following high-profile investors in detail:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.