“What do you want to do?”

“I want to work in a cool job with cool people.”

“OK…doing what exactly?”

“um…well…I mean…”

This was a conversation that occurred in my senior year of college with the guidance counselor.

I knew I wanted to work in finance in some capacity because I liked numbers, but beyond that, I had no plan.

Finding a job after college was difficult because I didn’t know what I wanted to do with my life. There were loads of interviews in banking, but they wanted me to be in sales. That wasn’t going to work.

Eventually, I landed a job as an analyst with a small investment consulting firm. My boss started out managing money for one of the biggest hospital systems in Detroit. He was so good at it that several other hospitals approached him to manage their money.

I still remember my first day on the job having to look up what bond credit ratings were because I had no idea how they worked. I had a lot to learn.

There are generally two types of jobs when you’re first starting out — learning jobs and earning jobs. This was a learning job because I certainly wasn’t earning that much.

I was dating my now wife at the time but she was going back to school on the other side of the state. So every night I would get home from the office, go to the gym, eat some dinner and then read for 2-3 hours a night.

I read every investment book I could get my hands on. I highlighted and underlined. I took notes.1

My boss taught me about asset allocation, investment policy statements, risk profiles, and how to communicate effectively with clients.

I was still so green I didn’t realize those early years were setting a baseline of investment knowledge I would use for years to come.

Then we got married. I moved back across the state to work for the investment office at a nonprofit with a billion-dollar endowment fund.

I joined in July 2007, right as the financial system was on the brink of imploding. Those first 3-4 years on the job, living through the Great Financial Crisis and its aftermath, were formative for me as an investor.

I learned a lot about how to survive a four-alarm crisis, career risk and patience.

I was at that job for a decade, getting the opportunity to work with every asset class and investment strategy imaginable — stocks, bonds, commodities, hedge funds, private equity, venture capital, infrastructure, structured products and more. More learning.

I worked with intelligent people who were good at what they did but I was itching to do something else. However, just like college, I didn’t really know what that something else was.

After getting my CFA designation, I went back to school at night to get an MBA. One of my classmates had a blog and showed me how to build a website. Coming out of the financial crisis I had a lot of thoughts racing through my mind so it sounded like a good outlet.

On a whim, I started A Wealth of Common Sense.

In the first six months or so, no one read it besides friends and family, but I discovered my love for writing. I was able to organize everything I had learned to understand what I actually thought about investing. It was illuminating.

Josh Brown and Barry Ritholtz were huge inspirations for the blog. I was late discovering them in 2012-ish, so I went back through and read all of their most popular posts. I became a daily consumer of their content.

After he wrote a piece about hedge funds, I summoned the nerve to email Josh about my experience in the institutional investment industry. I explained how I preferred simplicity over complexity and how that was lacking in the space.

Josh told me if I really felt that strongly about it, I should write a blog post and send it to him. That’s what I did. I worked really hard on it. Josh liked it so much that he posted it on his blog (anonymously).

He gave me some good feedback and said I should consider writing more often. I shared with him a link to my blog that no one was reading.

Josh became a reader and supporter of my work. He shared it on The Reformed Broker and social media. Eventually, Tadas at Abnormal Returns picked it up as well. My audience grew. Then came a book deal.

It was all so unexpected. I wasn’t trying to build a brand or an audience or sell anything. I just enjoyed writing about markets and investor behavior.

Josh and Barry started Ritholtz Wealth in 2013. I got to know them on work trips to New York City and met Michael too.

On a phone call with Josh, as I was complaining about my career trajectory, he stopped me and asked what I wanted to do with my life.

I finally had an answer.

I told him I wanted to work with clients of all shapes and sizes, continue producing content, and utilize that content in my everyday job. I also wanted to work with people who shared my philosophy on the types of clients and portfolios we should be working with.

I wanted to enjoy finance more.

Josh said, “OK come do that with us.”

The rest is history.

I’ve been with Ritholtz Wealth for almost a decade, and the business has grown considerably in that time. When I joined as the seventh member of the team, we were a start-up RIA managing around $140 million.

Today our team is 60+ (and growing) and we manage more than $5 billion for more than 1,000 households and organizations.

I get to work in a cool job with cool people, just like my 22-year-old self wanted.

I put in a lot of hard work but also got lucky.

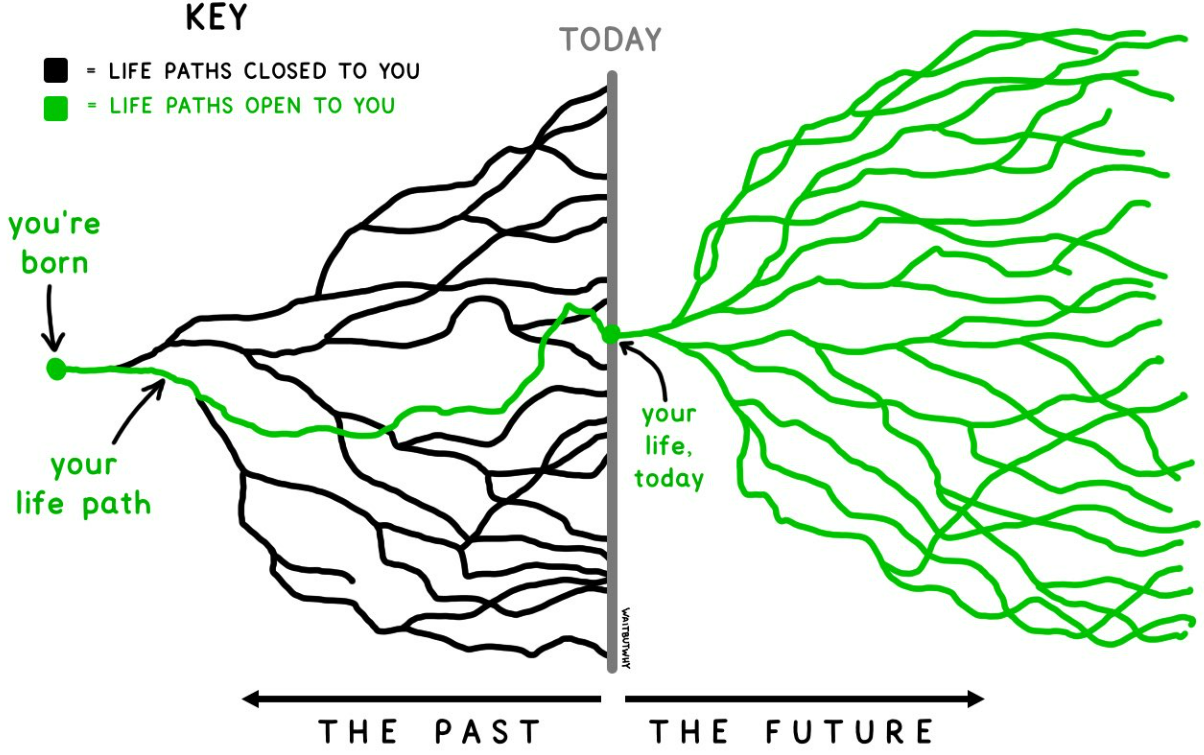

Tim Urban created this wonderful visual that that shows the potential paths your life can take:

I think about this kind of thing a lot.

One fork in the road here or there and my career could have turned out vastly different. All the jobs I didn’t get. Risks that didn’t pan out. Risks I could have taken.

Giving young people career advice is always difficult because so much of your path is determined by some combination of hard work, circumstances and dumb luck.

If there is anything to take from my story it’s this:

Always be learning. Sometimes you learn what works. Other times you learn what doesn’t work. Sometimes information helps in the moment. Other times it takes years for the right lessons to sink in.

Being a lifelong learner has been a tremendous benefit to my career.

Put yourself out there. Someone once told me blogging is sales for introverts. That checks out for yours truly but it was still nerve-wracking putting myself out there.

The Internet can be an unforgiving place. You need thick skin.

Many people in my life looked at me like I was crazy for pursuing a career based on a blog and relationships that were forged on the web.

You’re leaving a billionaire family to work with some guys you met on the Internet?!

It was a risk that never felt risky to me because it was exactly what I wanted to do with my career.

Sometimes you just have to take the leap and see what happens.

You never know when someone will take a chance on you.

Michael and I were live from Huntington Beach at Future Proof this week talking about our non-traditional career paths and more:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Some Things I Don’t Want When I Grow Up

Now here’s what I’ve been reading lately:

Books:

1I still have some of those old notebooks in my office.