A reader asks:

I was in the camp that the Fed wasn’t going to cut rates at all in 2024. Alas, it looks like I will be wrong and a September or November rate cut is all but assured at this point. So what are the portfolio implications if we enter a rate cutting cycle? When do I get out of my T-bills?

The Fed probably should have cut rates at their meeting this week but I suppose a couple of months shouldn’t matter in the grand scheme of things.

My contention is the Fed matters far less than most people assume when it comes to the markets. Sure, they have the ability to affect the markets in the short-term and during times of crisis, but Jerome Powell is not the wizard behind the curtain pulling all the strings.

The Fed doesn’t control the stock market. And they only control the short end of the bond market.

However, changes to interest rates do impact your portfolio. It can be helpful to understand what can happen to the financial markets when the Fed raises or lowers short-term rates.

The reason for the Fed rate cut probably matters more than the rate cut itself.

If the Fed is cutting rates in an emergency fashion, like they did during the Great Financial Crisis, that’s a different story than the Fed cutting because the economy and inflation are cooling off.

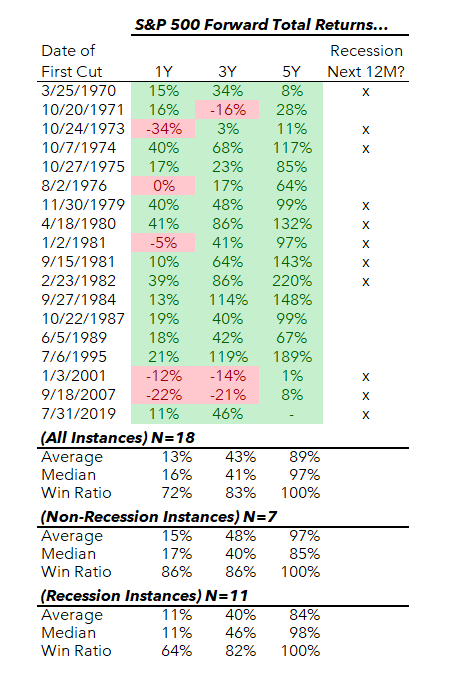

Here’s a look at the forward 1, 3, and 5 year returns for the S&P 500 following the Fed’s first rate cut going back to 1970:

Most of the time stocks were up. The only times the S&P 500 was down substantially a year later occurred during the 1973-74 bear market, the bursting of the dot-com bubble and the 2008 financial crisis.

It’s been rare for stocks to be down three years later and the market has never been down five years after the initial rate cut.

Sometimes the Fed cuts because we are in or fast approaching a recession, but that’s not always the case.

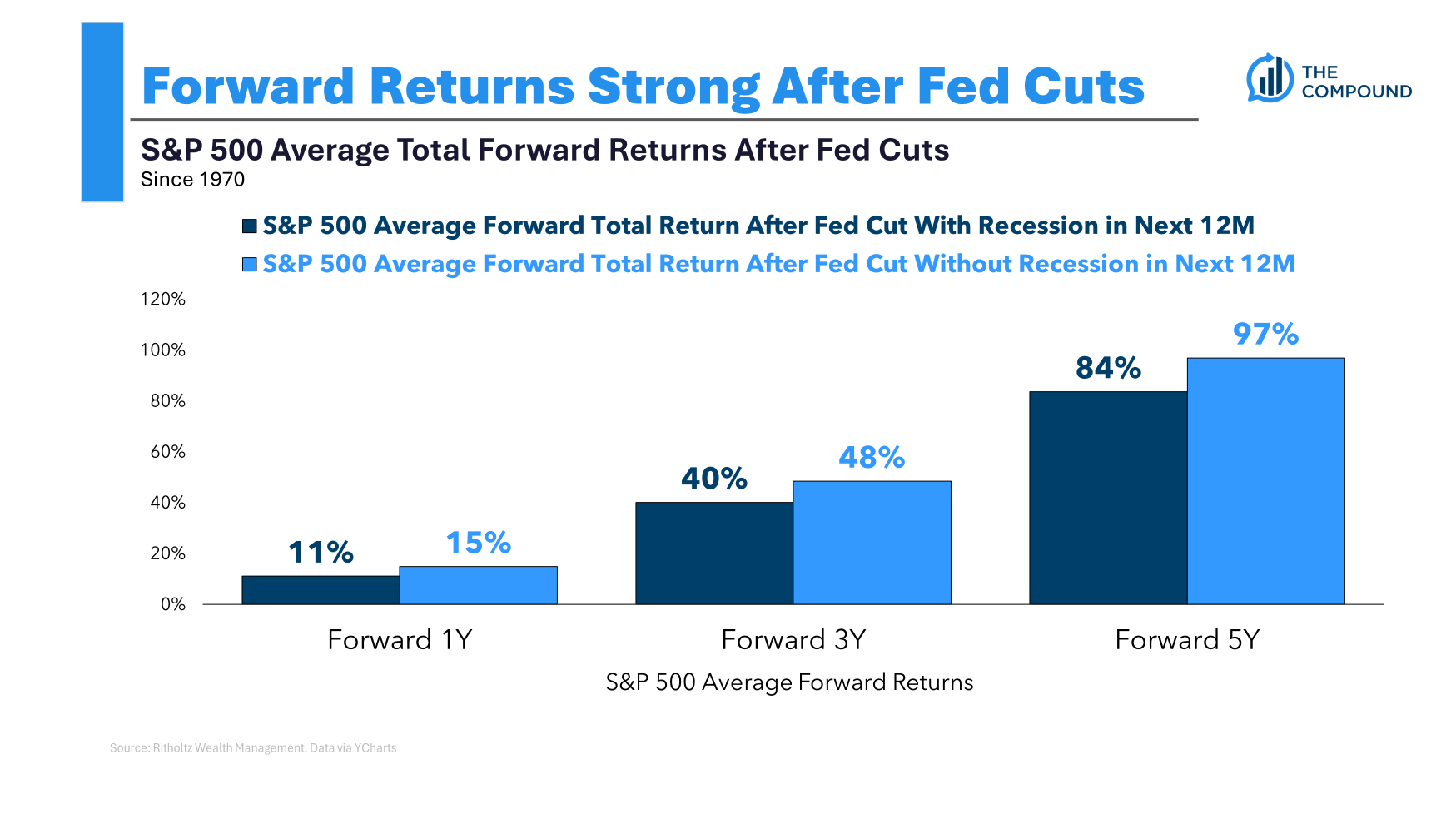

Here’s a look at the differences in forward returns during recession and non-recessionary rate cut situations:

Average returns have been better when no recession occurs but the disparity isn’t as large as you would assume.

Most of the time the stock market goes up but sometimes it goes down applies to Fed rate cuts just like it does to every other point in time.

Obviously, every rate cut cycle is different. This time it’s going to happen with stocks at or near all-time highs, big gains from the bottom of a bear market, a presidential election, and the sequel to Gladiator coming out this fall.

I’m not sure rate cuts signal much of anything to the stock market right now, considering it’s forward-looking and already knows the inflation data cooled and the Fed will cut at some point.

The stock market cares about earnings so the economy cooling off or remaining strong likely matters more than a couple of rate cuts by the Fed.

Where the rate cuts really matter are for the yields on your cash and cash-like securities.

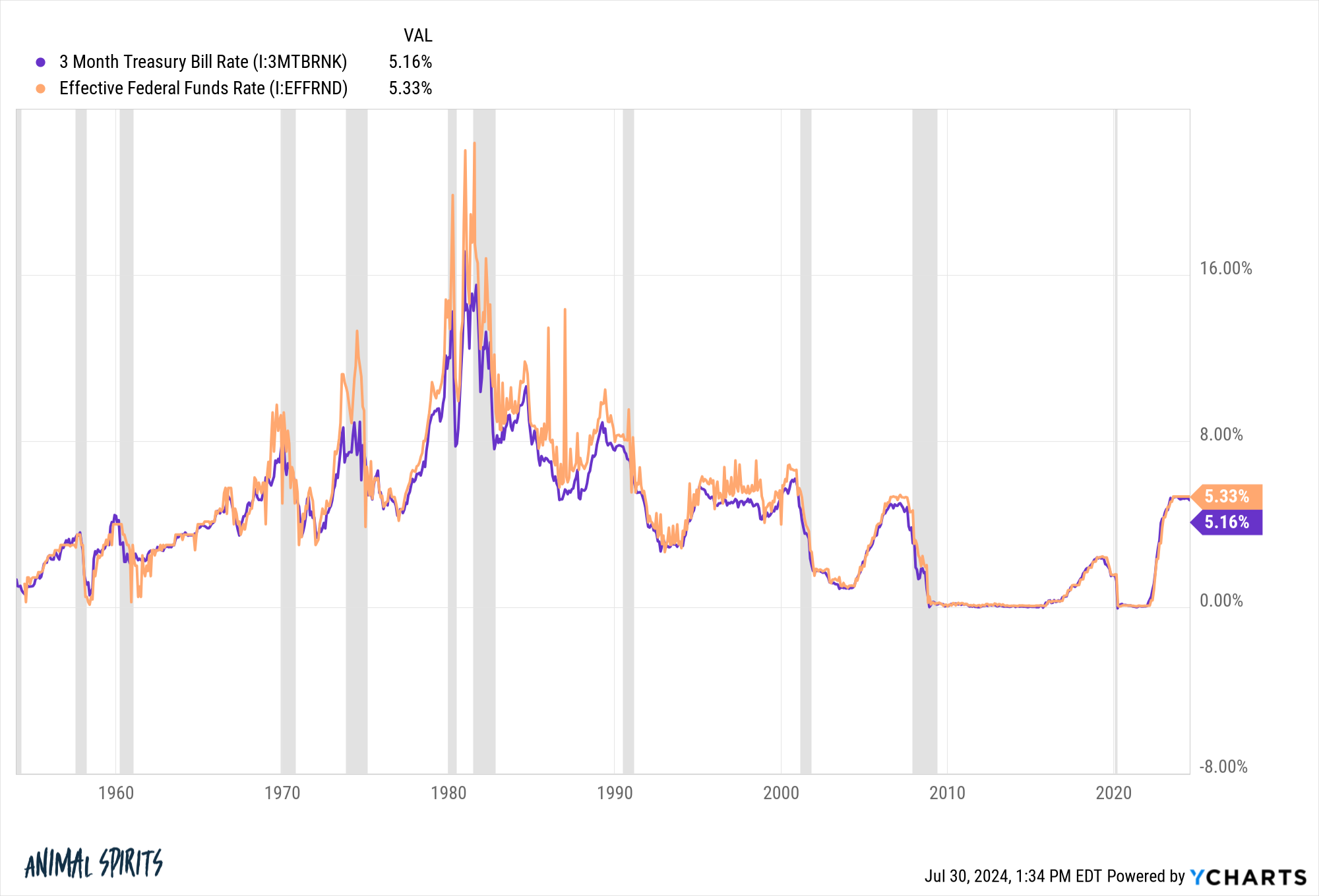

You can see the 3 month T-bill yield is essentially the same thing as the Fed Funds Rate:

When the Fed cuts rates you will see yields drop on T-bills, savings accounts, money market funds, CDs, etc.

Holding cash equivalents during the rate hiking cycle was an intelligent move. There was no interest rate risk. The yields on these products and accounts adjust quickly when rates rise (or fall). Plus, the yields on T-bills and the like were higher than longer duration fixed income because the yield curve was inverted.

Longer-dated bonds had lower yields and experienced massive drawdowns from rising rates. Cash had higher yields, no nominal drawdowns, and no volatility.

It was the best of both worlds.

Things become a little trickier now.

There is reinvestment risk in cash equivalents. When the Fed cuts rates, those yields will fall and fall quickly. Obviously, it depends how far the Fed cuts rates during this cycle.

Many investors would be perfectly content to hold onto T-bills if rates go from north of 5% to 4% or so. But when do you start getting nervous? Do you still want those T-bills at 3%?

As with most allocation decisions, there are no right or wrong answers here. These choices boil down to why you hold T-bills in the first place.

Were you looking for liquidity, a lack of volatility and a safe space to avoid nominal drawdowns?

T-bills provide that no matter what the Fed does. You just might not be paid as much going forward.

Were you hiding out from interest rate risk in bonds with a higher yield to boot?

Do you want to move out further on the risk curve to lock in higher yields or benefit from a potential decline in rates?

The bond market doesn’t wait around for the Fed.

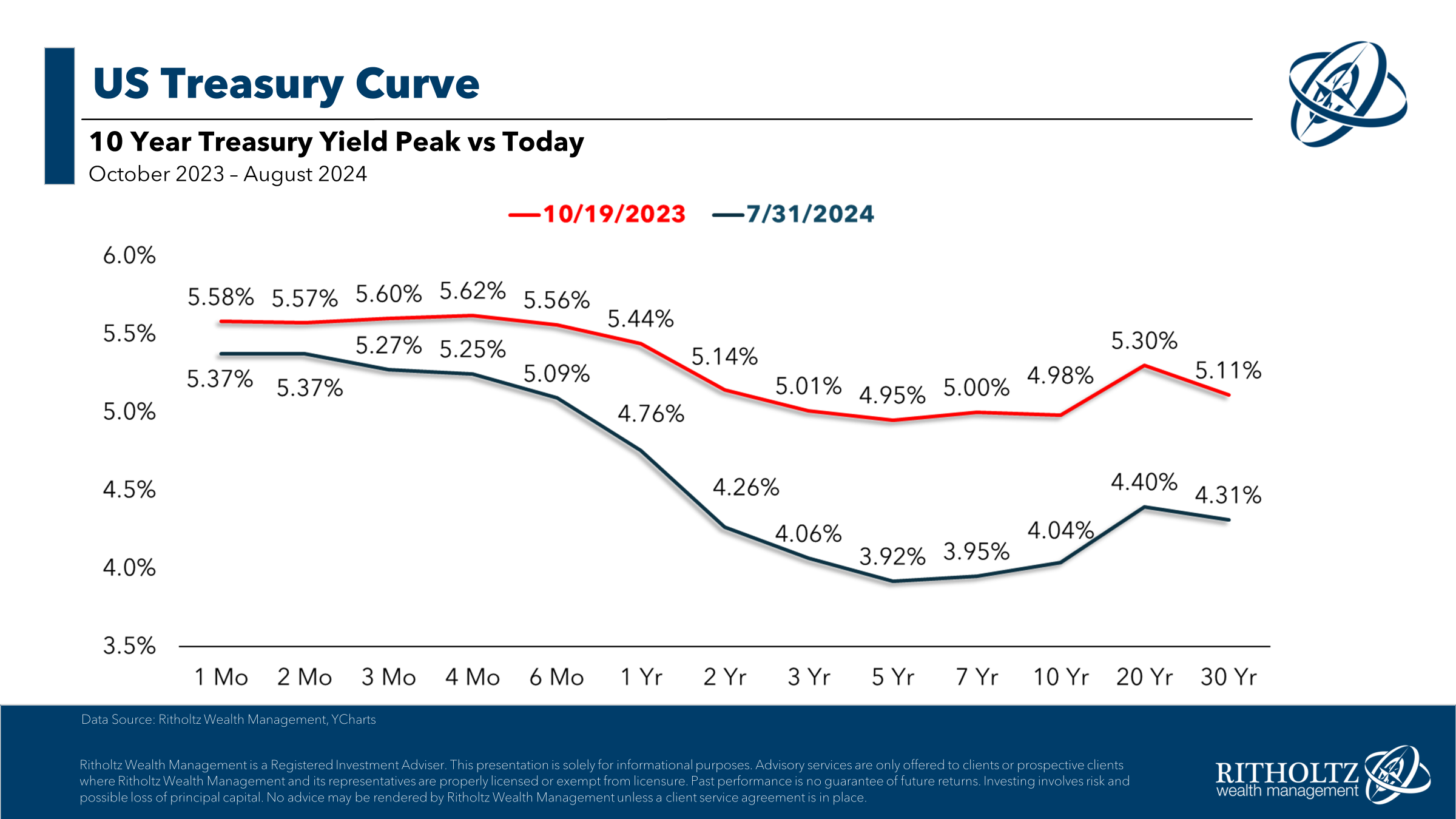

The 10 year Treasury yield spiked to 5% in October of last year.1 Here’s how the yield curve has changed since then:

The bond market knew rate cuts were coming and moved in anticipation of them. Today’s yields are still much better than they were before the rate-hiking cycle began, but it’s difficult to know how much of the Fed’s moves have already been priced in.

Bonds do have a much higher margin of error with rates at current levels, still provide a nice hedge against deflation or disinflation and can serve as a flight to safety during a recession.

So, there’s not much we can say with certainty about a rate cut. It all depends on the number of rate cuts, economic performance, the number of new Taylor Swift concert dates, etc.

The good news is you don’t have to go to the extremes, put all of your fixed income eggs in one basket and nail the timing of the interest rate cycle.

There can be a place for cash equivalents in your portfolio as long as you understand the pros and cons of this asset class.

There can be a place for bonds in your portfolio as long as you understand the pros and cons of this asset class.

The fact that we’re starting from much higher yield levels than we’ve seen in the previous 15 years or so gives you a higher margin of safety in whatever route you choose.

My only advice would be to avoid trying to jump in and out of these asset classes based on your own interest rate forecasts.

No one can predict the direction of interest rates or the magnitude of the moves before they happen.

I prefer to look at these allocation decisions through the lens of the trade-offs between risk and reward.

Every investment decision requires trade-offs.

We spoke about this question on this week’s all new Ask the Compound:

Our resident insurance expert and financial advisor, Jonathan Novy, joined me on the show this week to discuss questions about life insurance vs. investing, HELOCs, taking out a loan to remodel your house and how the step-up basis works when one spouse passes away.

Further Reading:

The Fed Matters Less Than You Think

1There were a lot of theories about the reasoning for this at the time. See here.