Published on November 26th, 2024 by Bob Ciura

Spreadsheet data updated daily

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

We’ve compiled a list that includes every Dividend King. You can see the full downloadable spreadsheet of all 54 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The Dividend Kings list includes several mega-cap stocks that have enormous businesses, such as Walmart Inc. (WMT) and Coca-Cola (KO).

But there are also smaller companies that have generated strong shareholder returns, and have increased their dividends for over 50 years.

The following 10 stocks represent the Dividend Kings with the smallest market caps.

Table of Contents

Dividend Kings Overview

The requirements to be a Dividend King are relatively simple: 50 consecutive years of dividend increases. Unlike the Dividend Aristocrats, there are no other requirements.

There are currently 54 Dividend Kings. The Dividend Kings are overweight in the Industrials, Consumer Staples, and Utilities sectors. At the same time, the Dividend Kings list is underweight the technology sector.

The following section lists the 10 Dividend Kings with the smallest market caps.

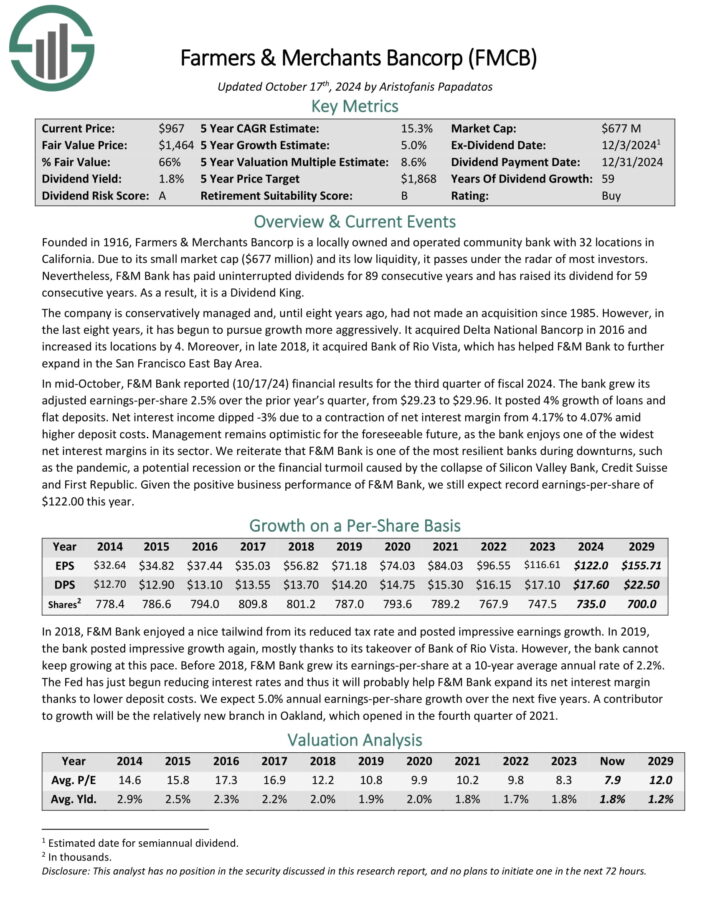

Dividend King You’ve Never Heard Of: Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In mid-October, F&M Bank reported (10/17/24) financial results for the third quarter of fiscal 2024. The bank grew its adjusted earnings-per-share 2.5% over the prior year’s quarter, from $29.23 to $29.96.

It posted 4% growth of loans and flat deposits. Net interest income dipped -3% due to a contraction of net interest margin from 4.17% to 4.07% amid higher deposit costs.

F&M Bank is a prudently managed bank, which has always targeted a conservative capital ratio. The bank currently has a total capital ratio of 14.95%, which results in the highest regulatory classification of “well capitalized.”

Moreover, its credit quality remains exceptionally strong, as there are extremely few non-performing loans and leases in its portfolio.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

Dividend King You’ve Never Heard Of: Gorman-Rupp Co. (GRC)

Gorman-Rupp began manufacturing pumps and pumping systems back in 1933. Since that time, it has grown into an industry leader with annual sales of nearly $700 million and a market capitalization of $1 billion.

Today, Gorman-Rupp is a focused, niche manufacturer of critical systems that many industrial clients rely upon for their own success.

Gorman Rupp generates about one-third of its total revenue from outside of the U.S.

Source: Investor Presentation

Gorman-Rupp posted third quarter earnings on October 25th, 2024. Results were weaker than the analysts’ estimates but still they reflected strong growth over the prior year.

Revenue grew marginally (0.4%), from $167.5 million to $168.2 million, as price hikes offset a decrease in volumes.

Adjusted earnings-per-share of $0.49 missed the analysts’ consensus by $0.06, but they were 44% higher than those in the prior year’s period. The strong performance resulted primarily from price hikes and lower input costs.

Click here to download our most recent Sure Analysis report on GRC (preview of page 1 of 3 shown below):

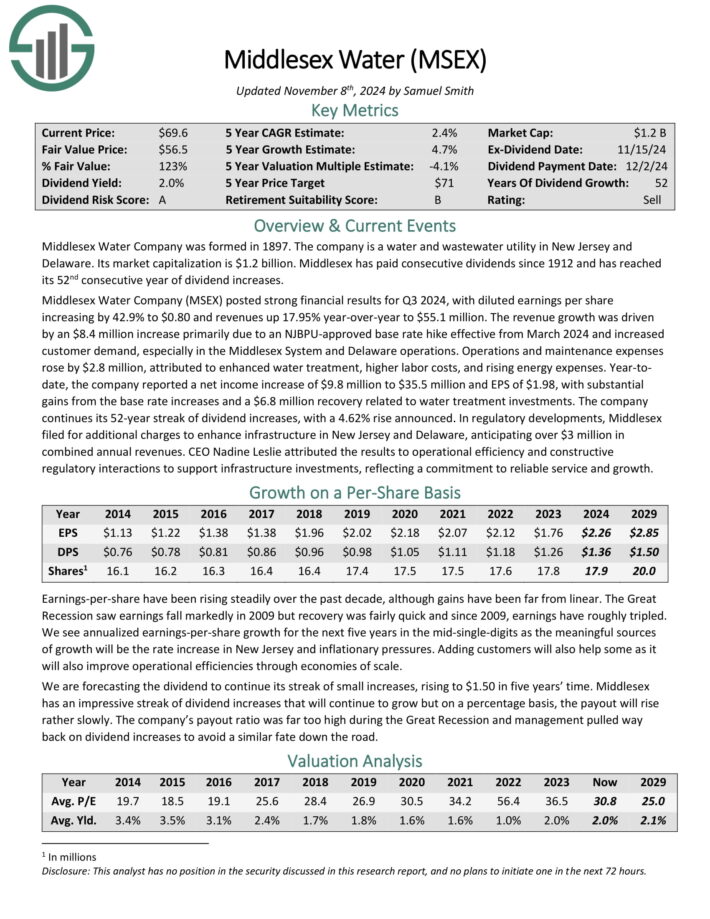

Dividend King You’ve Never Heard Of: Middlesex Water Co. (MSEX)

Middlesex Water Company was formed in 1897, making the company one of the oldest water and wastewater utility names in the U.S. The company has operations primarily in New Jersey, and annual revenue of approximately $180 million.

Like many of its peers, Middlesex is primarily focused on the regulated portion of its business.

Source: Investor Presentation

Middlesex provides basic water-related services to customers, such as selling, distributing, collecting, and treating water. The non-regulated business includes service contracts that include the operation and maintenance of municipal private water and wastewater systems in New Jersey and Delaware.

The vast majority of revenue comes from the regulated side. One of its largest service areas includes Middlesex County, where the company provides water services to over 61,000 retail customers. This business contributed ~60% of revenue last year.

Middlesex reported third-quarter earnings in late October. Revenue grew 18% over the prior year’s quarter and earnings per share grew 43%, from $0.56 to $0.80, exceeding the analysts’ estimates by $0.12.

Click here to download our most recent Sure Analysis report on MSEX (preview of page 1 of 3 shown below):

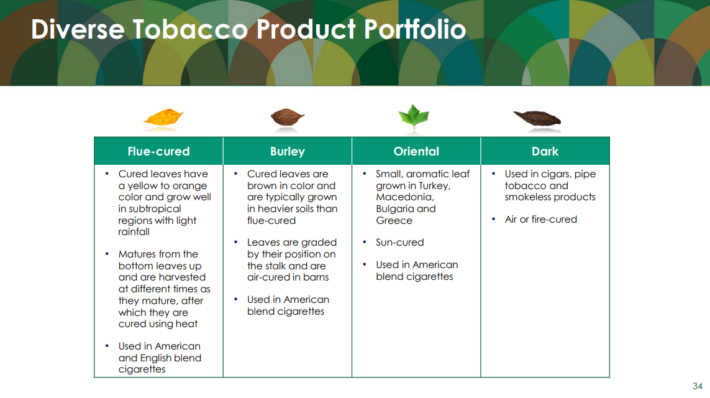

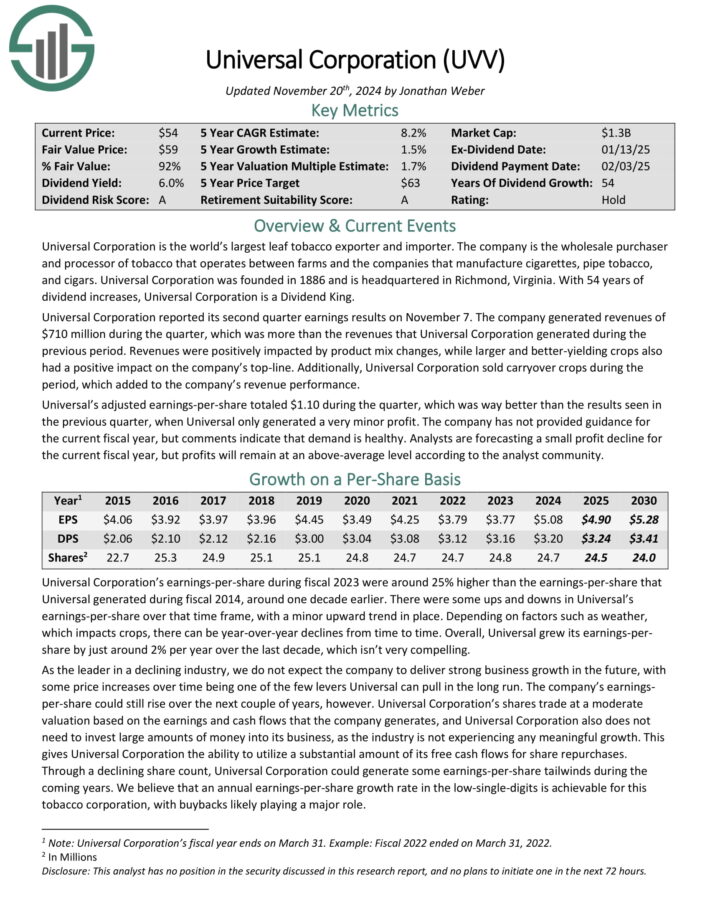

Dividend King You’ve Never Heard Of: Universal Corp. (UVV)

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its second quarter earnings results on November 7. The company generated revenues of $710 million during the quarter.

Additionally, Universal Corporation sold carryover crops during the period, which added to the company’s revenue performance.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

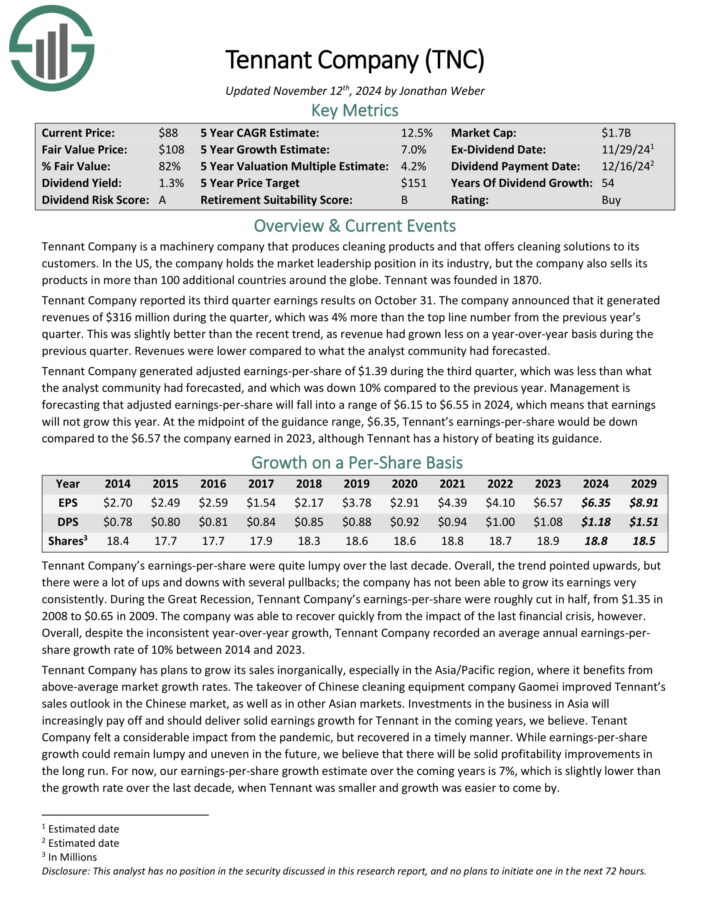

Dividend King You’ve Never Heard Of: Tennant Co. (TNC)

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers.

In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe.

Source: Investor Presentation

Tennant Company reported its third quarter earnings results on October 31st. The company announced that it generated revenues of $316 million during the quarter, which was 4% more than the top line number from the previous year’s quarter.

This was slightly better than the recent trend, as revenue had grown less on a year-over-year basis during the previous quarter. Revenues were lower compared to what the analyst community had forecasted.

Tennant Company generated adjusted earnings-per-share of $1.39 during the third quarter, which was less than what the analyst community had forecasted, and which was down 10% compared to the previous year.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

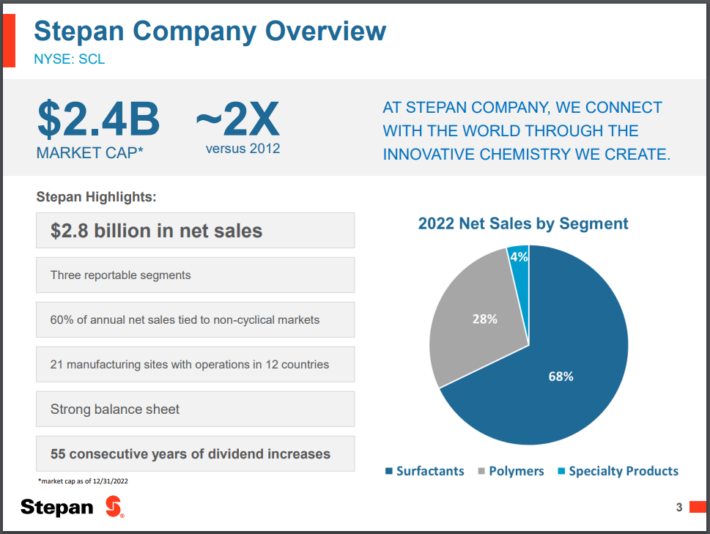

Dividend King You’ve Never Heard Of: Stepan Co. (SCL)

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to a handful of industries; an important trait during an economic downturn.

Source: Investor presentation

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted third quarter earnings on October 30th, 2024, and results were mixed. Adjusted earnings-per-share came in well ahead of expectations at $1.03, which was 38 cents better than expected. Revenue, however, was off almost 3% year-over-year to $547 million, and missed estimates by over $30 million.

Global sales volume fell 1% year-over-year, as double-digit growth in several of the company’s Surfactant end markets were fully offset by demand weakness in Polymers.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

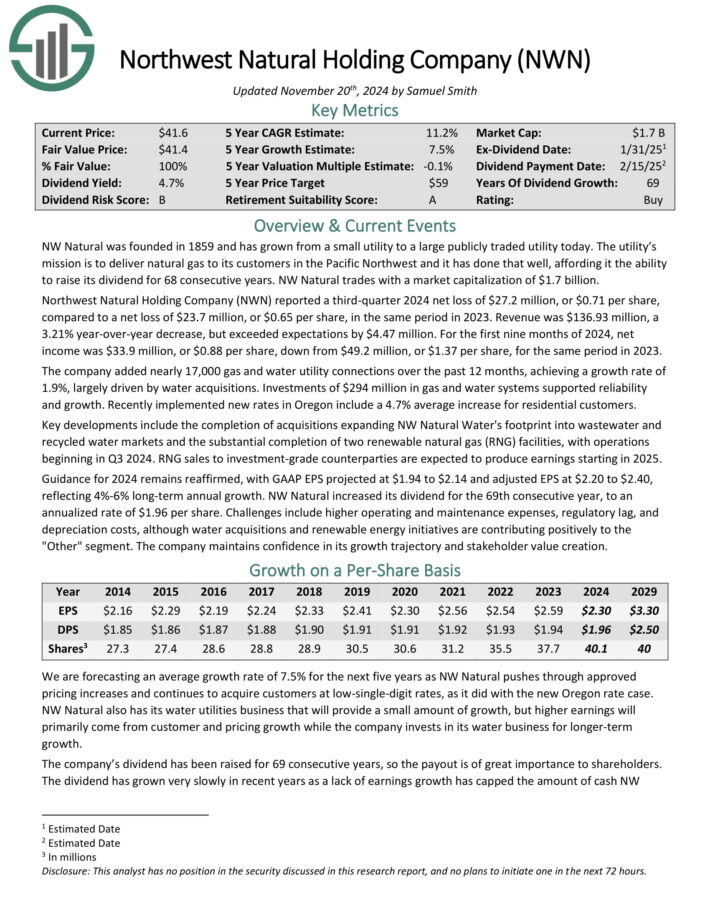

Dividend King You’ve Never Heard Of: Northwest Natural Holding (NWN)

Northwest was founded over 160 years ago as a natural gas utility in Portland, Oregon.

It has grown from a very small, local utility that provided gas service to a handful of customers to a very successful regional utility with interests that now include water and wastewater, which were purchased in recent acquisitions.

The company’s locations served are shown in the image below.

Source: Investor Presentation

Northwest provides gas service to 2.5 million customers in ~140 communities in Oregon and Washington, serving more than 795,000 connections. It also owns and operates ~35 billion cubic feet of underground gas storage capacity.

Northwest Natural Holding Company reported a third-quarter 2024 net loss of $27.2 million, or $0.71 per share, compared to a net loss of $23.7 million, or $0.65 per share, in the same period in 2023. Revenue was $136.93 million, a 3.21% year-over-year decrease, but exceeded expectations by $4.47 million.

For the first nine months of 2024, net income was $33.9 million, or $0.88 per share, down from $49.2 million, or $1.37 per share, for the same period in 2023.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

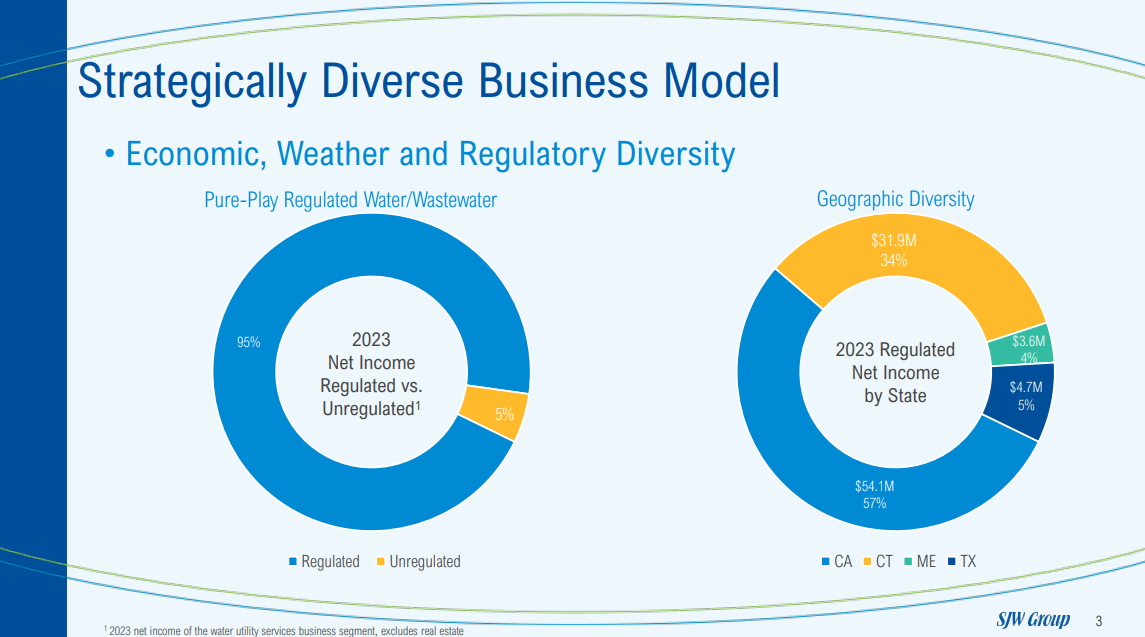

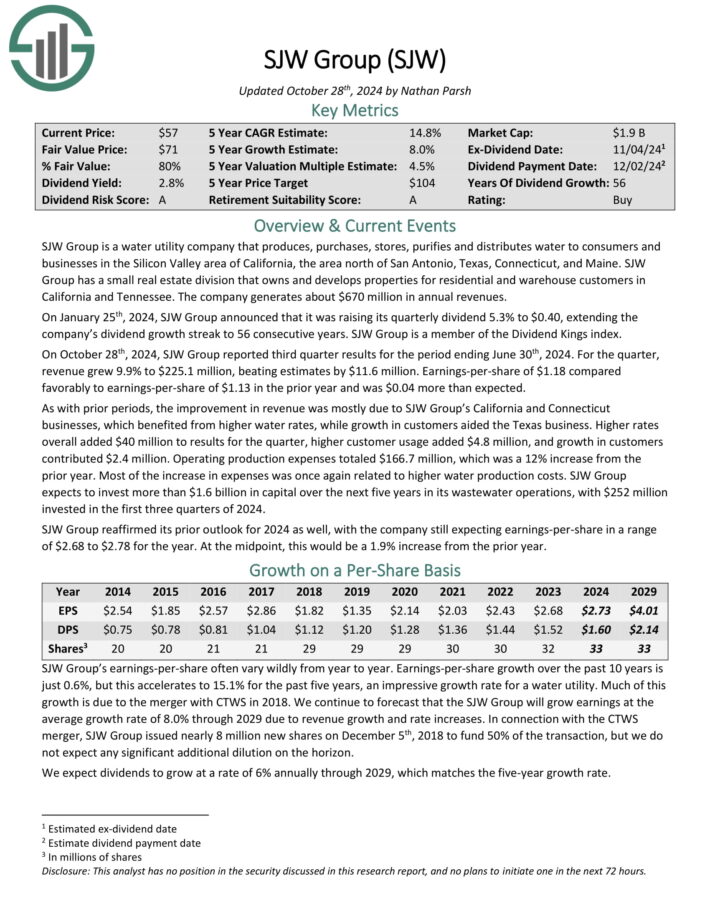

Dividend King You’ve Never Heard Of: SJW Group (SJW)

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

Source: Investor Presentation

On October 28th, 2024, SJW Group reported third quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 compared favorably to earnings-per-share of $1.13 in the prior year and was $0.04 more than expected.

As with prior periods, the improvement in revenue was mostly due to SJW Group’s California and Connecticut businesses, which benefited from higher water rates, while growth in customers aided the Texas business.

Higher rates overall added $40 million to results for the quarter, higher customer usage added $4.8 million, and growth in customers contributed $2.4 million. Operating production expenses totaled $166.7 million, which was a 12% increase from the prior year.

Click here to download our most recent Sure Analysis report on SJW (preview of page 1 of 3 shown below):

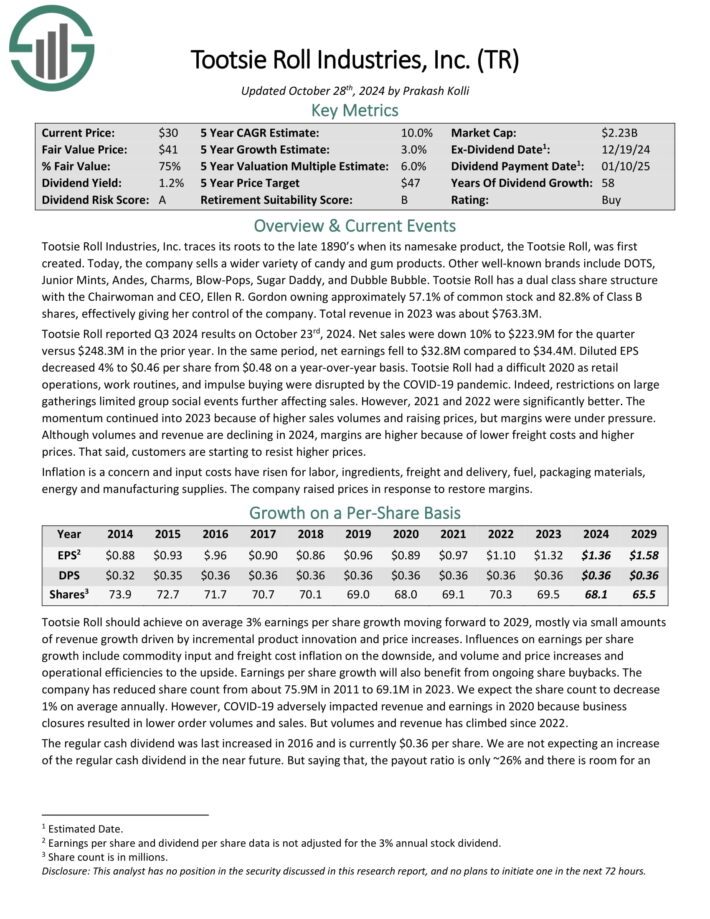

Dividend King You’ve Never Heard Of: Tootsie Roll Industries (TR)

Tootsie Roll Industries, Inc. traces its roots to the late 1890’s when its namesake product, the Tootsie Roll, was first created. Today, the company sells a wider variety of candy and gum products. Other well-known brands include DOTS, Junior Mints, Andes, Charms, Blow-Pops, Sugar Daddy, and Dubble Bubble.

Tootsie Roll has a dual class share structure with the Chairwoman and CEO, Ellen R. Gordon owning approximately 57.1% of common stock and 82.8% of Class B shares, effectively giving her control of the company. Total revenue in 2023 was about $763 million.

Tootsie Roll reported Q3 2024 results on October 23rd, 2024. Net sales were down 10% to $223.9M for the quarter versus $248.3M in the prior year. In the same period, net earnings fell to $32.8M compared to $34.4M. Diluted EPS decreased 4% to $0.46 per share from $0.48 on a year-over-year basis.

The company’s competitive advantage is the brand strength of its core product, the Tootsie Roll, and its lack of direct competition given the uniqueness of the product. Some of the company’s other brands are also well known.

Click here to download our most recent Sure Analysis report on TR (preview of page 1 of 3 shown below):

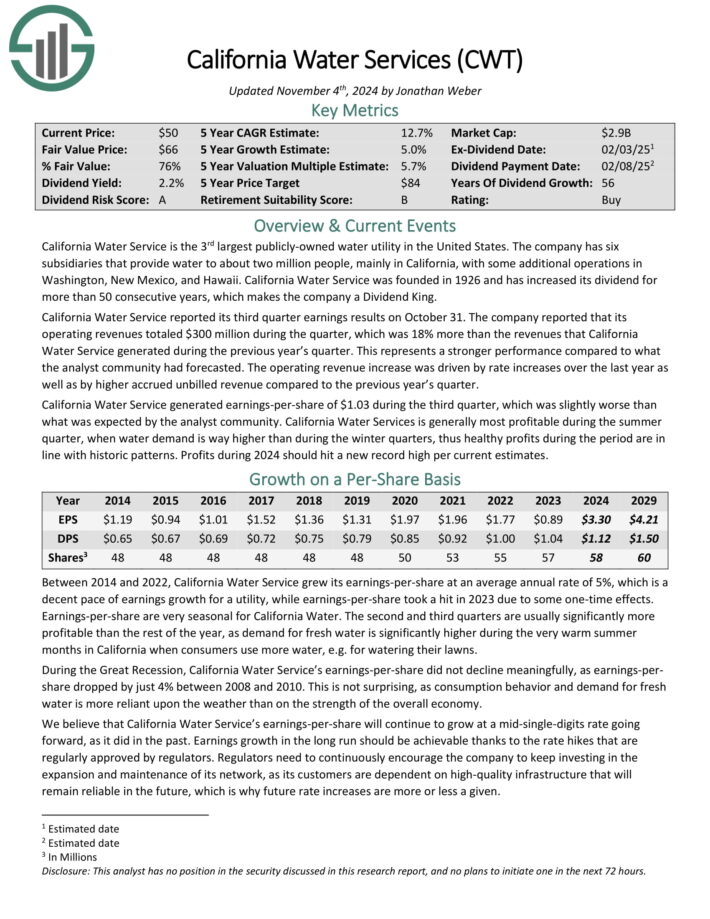

Dividend King You’ve Never Heard Of: California Water Service Group (CWT)

California Water Service is a water stock and is the third-largest publicly-owned water utility in the United States.

It was founded in 1926 and has six subsidiaries that provide water to approximately 2 million people in 100 communities, primarily in California but also in Washington, New Mexico and Hawaii.

Source: Investor Presentation

California Water Service reported its third quarter earnings results on October 31st. Operating revenues totaled $300 million during the quarter, which was 18% higher than the same quarter last year. This represents a stronger performance compared to what the analyst community had forecasted.

The operating revenue increase was driven by rate increases over the last year as well as by higher accrued unbilled revenue compared to the previous year’s quarter.

Click here to download our most recent Sure Analysis report on CWT (preview of page 1 of 3 shown below):

Additional Reading

The Dividend Aristocrats are among the best dividend growth stocks to buy and hold for the long run. But the Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

We have compiled a reading list for additional dividend growth stock investing ideas:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].