Market Outlook #262 (3rd April 2024)

Hello and welcome to the 262nd instalment of my Market Outlook.

In this week’s post, I will be covering Bitcoin, Ethereum, Cardano, Polygon, Optimism, Casper and Realio.

As ever, if you have any requests for next week, please do let me know via email or in the comments.

Bitcoin:

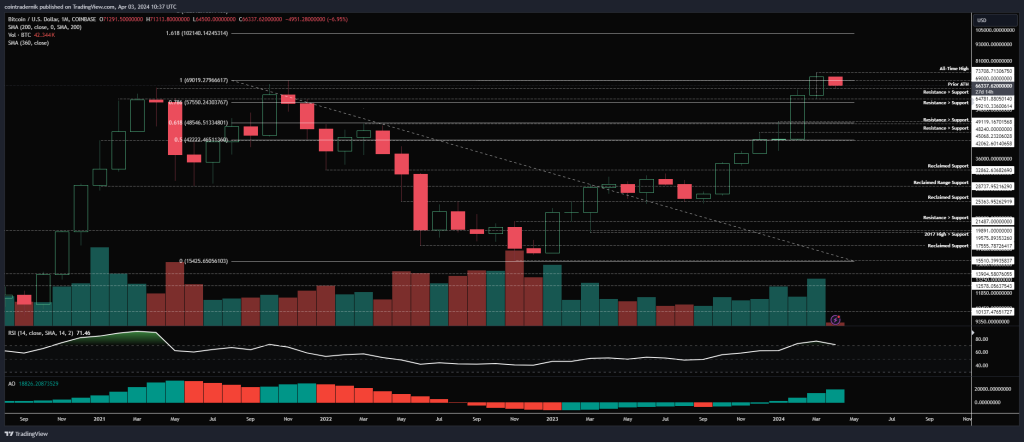

Monthly:

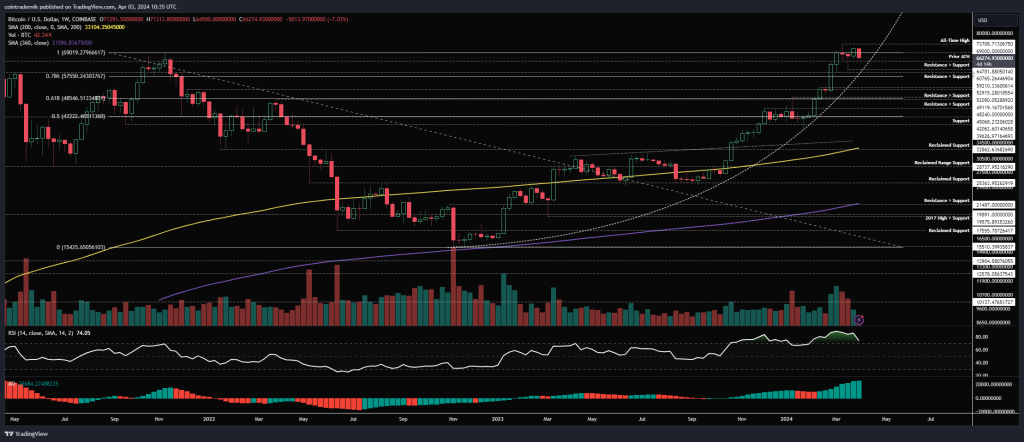

Weekly:

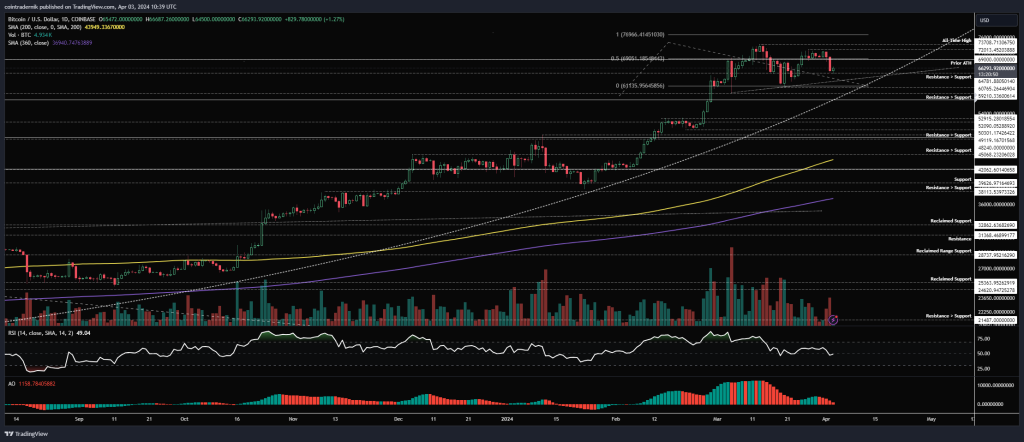

Daily:

Price:

Market Cap:

Thoughts: If we begin by looking at the monthly chart for BTC/USD, we can see that last month was the highest ever close for Bitcoin on the most volume in over a year, closing firmly through $69k into $71.3k. This is – as I am sure you are aware – not bearish. Looking at this timeframe, as long as we hold above $58kish in April, this still looks super bullish for the coming quarter. If April closes below $58k, we have a bit more of an issue, as it looks more like a false breakout than a real one, but with this volume profile and structure I am leaning heavily towards the notion that all April dips are for buying. Looking ahead, as long as we do hold above $58k, I think we see $100k traded by Q3, and we can see why in the weekly chart…

Looking at the weekly, the first thing to point out is that despite four weeks of consolidation around these all-time highs the parabolic advance remains intact, and we could continue to consolidate for a couple of weeks yet without breaking it. Weekly momentum indicators continue to point to higher prices with no exhaustion seen yet, and at the worst – as long as the parabola holds – I think we see a sharp wick below $61k into $59k and then bounce higher rapidly from there. The more bullish scenario here is the formation of a higher-low this week above $61k that leads to another stab at all-time highs next week, leading to an eventual breakout before May and subsequent price discovery, with the rallies getting sharper from there towards $100k by July.

At some point that parabola will break: it will either be soon, and we will see a longer consolidation through summer before reversal likely late in Q3 going into the election cycle; or in a few months time, after which I don’t know how the cycle would play out from a parabolic break of say $140k. If we look at the daily, we can see that some sort of ascending triangle is currently forming into those all-time highs and above the curve of the parabola. If we close the daily below that, that might be an early indicator of lost momentum and therefore the beginning of a larger move down, likely towards that $49-53k range in several weeks time. If, however, we continue to form higher-lows here into mid-April I think we push through $74k and begin the next leg. The liquidation cascade scenario would be a sharp wick through $61k that leads to a push into $59k – likely in the next week or so – before a hard v-reversal leaving late shorts trapped and liquidated longs chasing price higher. Let’s see how this week closes out…

Ethereum:

ETH/USD

Weekly:

Daily:

ETH/BTC

Weekly:

Daily:

Price:

Market Cap:

Thoughts: If we begin by looking at ETH/USD on the weekly timeframe, we can see that the pair is consolidating below $3580 resistance, closing marginally above it last week but on low volume in a tight range – and early this week selling off from that open back towards the prior low at $3057. For now, the pair is holding above that low, but I think its trajectory is dependent upon BTC/USD over the next week or two. If we drop into the daily for clarity, we can see how a lower-high has formed below $3726, but price is currently finding support and $3222 – the early March low. If this support holds for the rest of the week, I can see continuation higher through $3726 to invalidate the lower high next week. Now, if we close below $3222, I would expect $3057 to be taken out. What happens afterwards is reaction-dependent: if we sweep $3057 and close back above it, then pushing sharply back above $3222, I think we mark a bottom and continue higher from there; if instead we close below $3057 and that level acts as resistance, the pair is likely to return to $2735 before a bottom is found. I am currently leaning towards one of the first two scenarios, as unless $59k falls for BTC/USD, I can’t see us getting $2735 for ETH.

Turning to ETH/BTC, this pair looks particularly woeful and anaemic after the past week or two of grinding lower, and we are now pushing below the last line of defence at 0.051. If we close below this level, I think it is likely we take out the yearly low at 0.0478 into 0.0461. If we close the week above 0.051 like we have the last couple of weeks, that would show some strength from bulls and we may just be marking out a very choppy local bottom. It’s hard to get excited about ETH when the BTC pair is looking like this, but I’m sure we’ll get some sense of direction in the next couple of weeks…

Cardano:

ADA/USD

Weekly:

Daily:

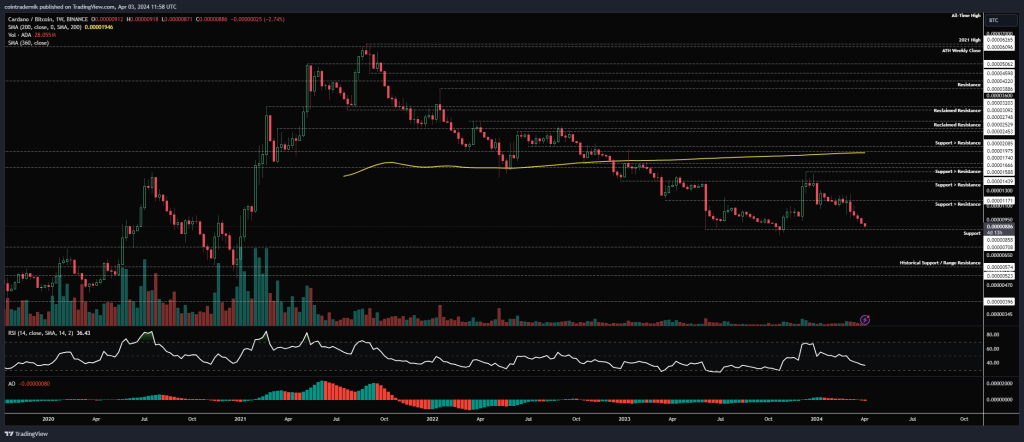

ADA/BTC

Weekly:

Daily:

Price:

Market Cap:

Thoughts: Beginning with ADA/USD, on the weekly we can see that price has rallied back to the 200wMA, finding resistance at $0.75 for three weeks before rejecting and moving lower, now at marginally back below resistance at $0.60, which was acting as support. We have momentum exhaustion here as well, supporting the idea that Cardano is an underperformer here, and I would expect price to float back towards $0.47 if we close below $0.60 this week. Dropping into the daily, we can see how $0.68 acted as reclaimed resistance after breaking back below it, and now structure is firmly bearish, with no sign of exhaustion just yet. If reject off of $0.60 as reclaimed resistance this week, I am looking at a return to that 200dMA and prior resistance turned support at $0.47-0.49. If bulls somehow turn up here, I think this is only a long back above $0.68, looking to buy that as resistance turned support and trade it higher into $0.90.

Turning to ADA/BTC, we can see that price rejected at 1588 satoshis and has been trending lower all year, retracing the entire rally from the October 2023 bottom back into support here at 858,. Now this is much more supportive for some relief for Cardano, given the reaction off this level late last year, but if we close the weekly below 858 that would be disastrous, with another 20% drop into the next support at 700 satoshis. If we do find support here again, that may provide confluence if the Dollar pair can get back above that $0.68 level for continuation higher.

Polygon:

MATIC/USD

Weekly:

Daily:

MATIC/BTC

Weekly:

Daily:

Price:

Market Cap:

Thoughts: If we begin by looking at MATIC/USD, we can see from the weekly that price is sat on trendline support from the October 2023 bottom and hovering above the 200wMA, having pushed below reclaimed support at $0.92 this week. MATIC bulls want to see this area hold firm and price to push back above $0.92 for the weekly close, which will then look more like a sweep of local lows into major support and likely a higher-low form continuation towards $1.31 and beyond. If, however, $0.92 begins to act as resistance next week, and we break below that trendline, I would expect to see another near 20% of downside towards $0.74 as the next major support. If we drop into the daily, we see similar structure to ADA/USD with no signs of trend exhaustion just yet, opening up the likelihood of that larger move lower into $0.74, with the 200dMA and 360dMA hovering above that. If we can catch a bid here and push back above $1, that’s a nice long for the $1.31 retest, with a view to hedge there and reopen on acceptance above that level.

Turning to MATIC/BTC, we can see just how poorly this has performed, breaking below multi-year support and turning it into resistance, then grinding lower for weeks, now sat in no man’s land at 1350 satoshis. There is no major support below this all the way into 948. There are also no signs yet of trend exhaustion here. If anything, you likely want to hold off any spot purchases until 1720 satoshis is reclaimed as support or price trades into that 948 level. Not attractive at all here.

Optimism:

OP/USD

Daily:

OP/BTC

Daily:

Price:

Market Cap:

Thoughts: Focusing here on OP/USD, given the relatively short price-history of Optimism, we can see that price formed an all-time high in March around $4.92, from which point it has retraced, breaking back below prior highs turned resistance at $4.24 and then pushing into support at $3, above which it currently sits. Structure is bearish here, as is momentum, but we have the beginnings of some exhaustion on the Awesome Oscillator. Nonetheless, I do think this continues to puke towards the 200dMA, likely sweeping the swing-low into $2.56 before marking out a bottom. As long as we don’t close below $2.33, I think this still just looks like a broad range above historical resistance turned support; close below that and this looks much more bearish. If we can mark out a bottom above $2.56, I am looking for $5.80 as the next target for my spot holdings.

Casper:

CSPR/USD

Weekly:

Daily:

CSPR/BTC

Weekly:

Daily:

Price:

Market Cap:

Thoughts: If we begin by looking at CSPR/USD, we can see from the weekly that the pair has been in a broad range for almost two years now, with more recent price action confined between support at $0.031 and support turned resistance at $0.055. We are back at the bottom of that shallower range within the broader range and this is largely just chop at present. Casper was born in the bear market and has only known a downtrend and a long flat consolidation, so it’s probably worth buying partials close to range support and adding to your position on a clean weekly close through $0.054, if you have fundamental conviction in this project. Above $0.054, I think the first bull cycle is likely to begin, and I wouldn’t be expecting anything less than $0.226 as a first target, but likely prices beyond $0.36 given it has never experienced a bull cycle.

Turning to CSPR/BTC, unlike the Dollar pair this is still in its long-term downtrend since inception, with recent price action breaking below prior all-time lows at 83 satoshis and pushing into 63, before turning that into resistance and now sitting at 52 satoshis. We have the makings of minor trend exhaustion here but we are very much in bearish price discovery. I would be looking for structure and momentum to show us clear signs of bullishness before stepping in to be honest. If we drop into the daily, this could take the form of a trendline breakout followed by a reclaim of 63 satoshis as support, which would make for a nice entry. If we break below 52, there is no knowing where this stops.

Realio:

RIO/USD

Weekly:

Daily:

RIO/BTC

Weekly:

Daily:

Price:

Market Cap:

Thoughts: Beginning with RIO/USD, we can see from the weekly that the pair has been in a strong uptrend since November 2022, continuing to hold to a parabolic advance, with last week seeing the pair push through the final resistance level at $2.74 on huge volume into $5.61, but ultimately reject and close back inside $2.73. Momentum indicators do not show signs on exhaustion here and rather I expect we see a couple of weeks of consolidation here before the breakout is validated and price continues to run higher towards the all-time highs at $10.72 in the next couple of months. As long as the parabola holds, there is no need to expect anything other than what we have already been seeing. If we break the parabola, it’s likely we get a deeper correction towards $0.99 before any continuation.

Turning to RIO/BTC, we can see that weekly structure is firmly bullish and last week saw price close through a cluster of resistance on great volume and with new highs on momentum indicators, finding resistance around 5772 satoshis and now consolidating between there and reclaimed support at 1836. As mentioned above, I would expect continued consolidation here before a weekly close through 5772, which will be the catalyst for the steepest part of the parabola, with no resistance between there and all-time highs. On this chart, that is marked out as 96k satoshis, but I think this is a misprint – either way, above 6k satoshis, I think you’re effectively in price discovery mode for the BTC pair. As long as this holds above 1155 structure is also still bullish, so there is a lot of downside we could see before any break in structure.

And that concludes this week’s Market Outlook.

I hope you’ve found value in the read and thank you for supporting my work!

As ever, feel free to leave any comments or questions below, or email me directly at [email protected].